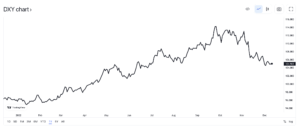

We’ve reported on the strength of the dollar on international trading floors over the first nine months of this year.

We’ve noted that strong dollar demand is a lead indicator that inflation will fall. And right on cue, the CPI has crept downward from its 9% high in the late Summer. In September the dollar hit a 20-year high relative to other major currencies.

But since September then the dollar has abruptly reversed course. After hitting a 20-year high this fall, the dollar is now down more than 8% from its September peak. That’s the swiftest fall in a decade.

A weakened dollar means imports rise in price, which means that the Fed’s job of getting to the 2% inflation target from 6 to 7% will be all the harder.

We are not out of the woods yet on inflation.