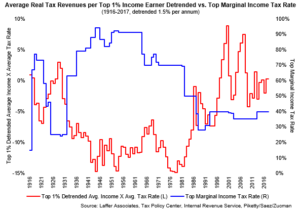

And lower tax rates, more revenue. Our co-founder Arthur Laffer examined 100 years of evidence on changes to federal income tax rates and the amount of tax payments by the rich. In almost all cases the relationship is negative. That’s because higher tax rates motivate the rich to engage in four forms of tax avoidance:

-

-

- Move money offshore

- Invest in tax shelters

- Park their fortunes in untaxed family charitable foundations

- Reduce their workload and taxable income

-

This is a great chart from Laffer Associates:

This is why we predict raising the highest income tax rate to 55% as Biden wants to do will lose revenue for the government over the long run.