We’ve warned that if Democrats sweep the elections in 2024 – and win the White House, Senate, and House – this will unleash a Bernie Sanders “soak the rich” tax increase almost unprecedented in American history. Tax rates on income and capital gains will rise to 50% or more.

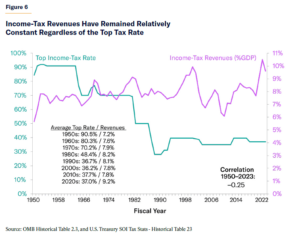

But this chart from our friend Brian Riedl of the Manhattan Institute tracks the income tax for almost 100 years and shows that higher income tax rates on the rich are NEGATIVELY associated with income tax receipts. In the early 1960s, when the top tax rate was 90% (!) income tax revenues captured roughly 8% of GDP. That was exactly the same tax-take after Reagan chopped the highest income tax rate down to 28%. Today at a 37% top tax rate (down from 40% during the Obama years) the income tax revenues are roughly 10% of GDP – again far higher than when the top rate was 70 to 90%.

There are two reasons that raising income tax rates is a futile way to raise revenue. First, the higher the tax rate, the more loopholes Congress adds to the tax code to get around the high rates. Second, high tax rates slow down the economy and thus depress tax collections.

Is this really so complicated?