It’s sad. The blue states keep doubling down on economically destructive policies.

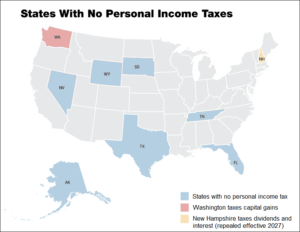

Liberal Washington State has long been a mecca for technology start-ups – from Amazon to Microsoft and hundreds more – in no small part because it is one of nine states without an income tax. Regular readers know that the no-income tax states create jobs at roughly twice the pace of high-income tax states.

But in 2021 the Democrat-dominated legislature decided it would slap its millionaires with a first-ever capital gains tax of 7% on annual gains of more than $250,000.

The state constitution forbids an income tax, but the State Supreme Court upheld the law by skirting the clear language of the law and called it an “excise tax.” With this twisted logic, the Court could say that a personal income tax is really just a sales tax on your labor services.

Washington has had a competitive advantage over neighbors California and Oregon, but they just flushed that away. At 7% Washington will now have one of the top taxes on the sale of stocks and other assets.

Washington is likely to fall at least 12 spots in the ALEC “Rich State, Poor State” rankings – from above average in the business climate to below average.

One woke business leader in Washington admitted that millionaires may move to Florida (where there is no income tax), but scoffed: “Hope you like the hurricanes and mosquitoes.”

Washington’s progressives forget that when the millionaires leave, they take their jobs and their capital with them. And they also forget that after they flee, 7% of zero is zero.