Imagine for a moment that Kamala Harris had won the election and the first thing she did as president was declare a “climate emergency,” and then unilaterally ordered a stiff carbon tariff on products imported into the United States.

Conservatives would be enraged by this unconstitutional power grab.

For good reason.

Article I Section 1 is the very first thing in the Constitution after the famous “We the People” preamble, so it must be pretty important:

“All legislative Powers herein granted shall be vested in a Congress of the United States, which shall consist of a Senate and House of Representatives.”

And when the specific powers of Congress are enumerated in Article I Section 8, the taxation power is the very first thing listed:

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises…

Regardless of how one thinks about the Trump tariffs, they ARE taxes. And they could surpass hundreds of billions of dollars in revenues.

Yet Congress had delegated its tariff power to the president for “emergency” purposes – such as in times of war.

Can anyone honestly argue that the current situation is an emergency as originally intended by the Framers?

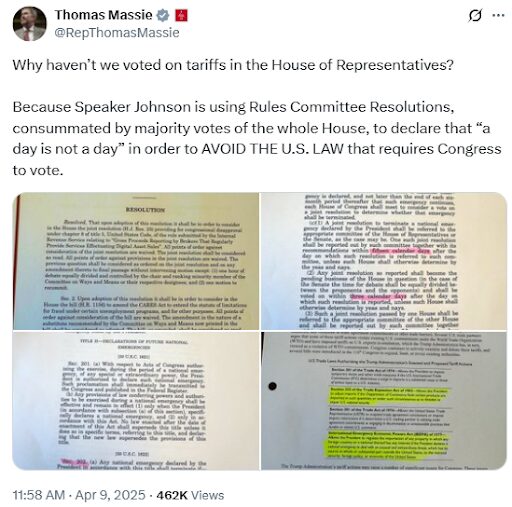

A Congressional vote on taxes that could run into the hundreds of billions of dollars seems imperative. And yet… there has been just one Senate vote (on the Canada “emergency”) and no vote in the House.

Ironically, the Supreme Court, at the urging of Republicans in Congress and conservatives around the country, through the Loper Bright decision, reined in the power grab of executive branch regulatory agencies to make laws without congressional approval.

But now, these same Republicans are assigning Congress’s taxing power over to the Executive Branch when it comes to tariffs.

This isn’t what our Founding Fathers had in mind.