The Congressional Budget Office estimates that the House-passed tax bill will lower federal revenues by nearly $4 trillion over the next decade. That forecast borders on economic malpractice.

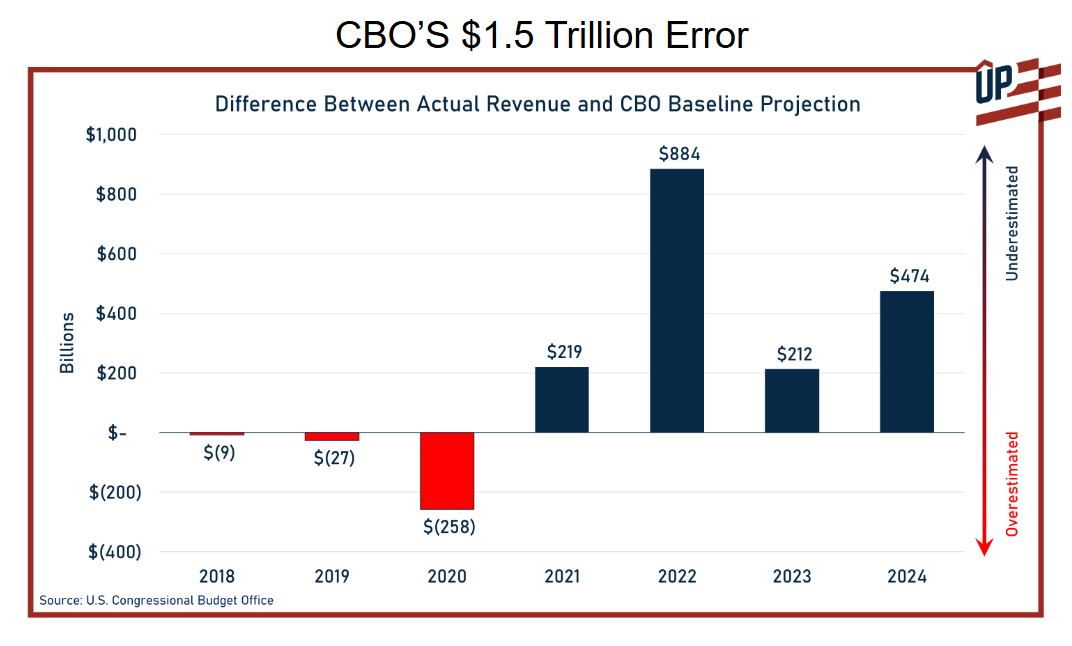

We know CBO and the Joint Committee on Taxation are wrong, because this same model overestimated the revenue loss of the 2017 Trump tax cut by $1.5 trillion in the first five years of the bill. That’s a gross error.

After decades of complaining about the JCT and CBO’s erroneous models, which ALWAYS overestimate the “cost” of tax cuts, they still refuse to fully take account of the economic benefits of lowering tax rates. It’s like a doctor tapping a patient’s knee and not expecting the leg to kick up.

If Trump’s America-first agenda of deregulation, lower tax rates, domestic energy production, government efficiency reforms, etc. raises the economic growth rate to just the historical average of 3% for the country, the burden of the deficit will fall, not rise.

Yet Congress is a slave to a model that is repeatedly wrong. Unlike a broken clock, they aren’t even right twice a day, as this piece by Steve Moore in today’s WSJ points out: