Everyone loves credit and debit cards and Apple Pay, except retailers who pay a small interchange fee (about 2%) for this service that the banks and the credit card companies offer. The percentage of electronic payments at stores has doubled in just the last five years as we move toward a cashless society.

The merchants want Congress to set price controls on the credit card industry, and Senator Dick Durbin of Illinois has legislation that he’s moving to do just that. As we’ve shown before, this will mean fewer lower income families will have access to credit cards.

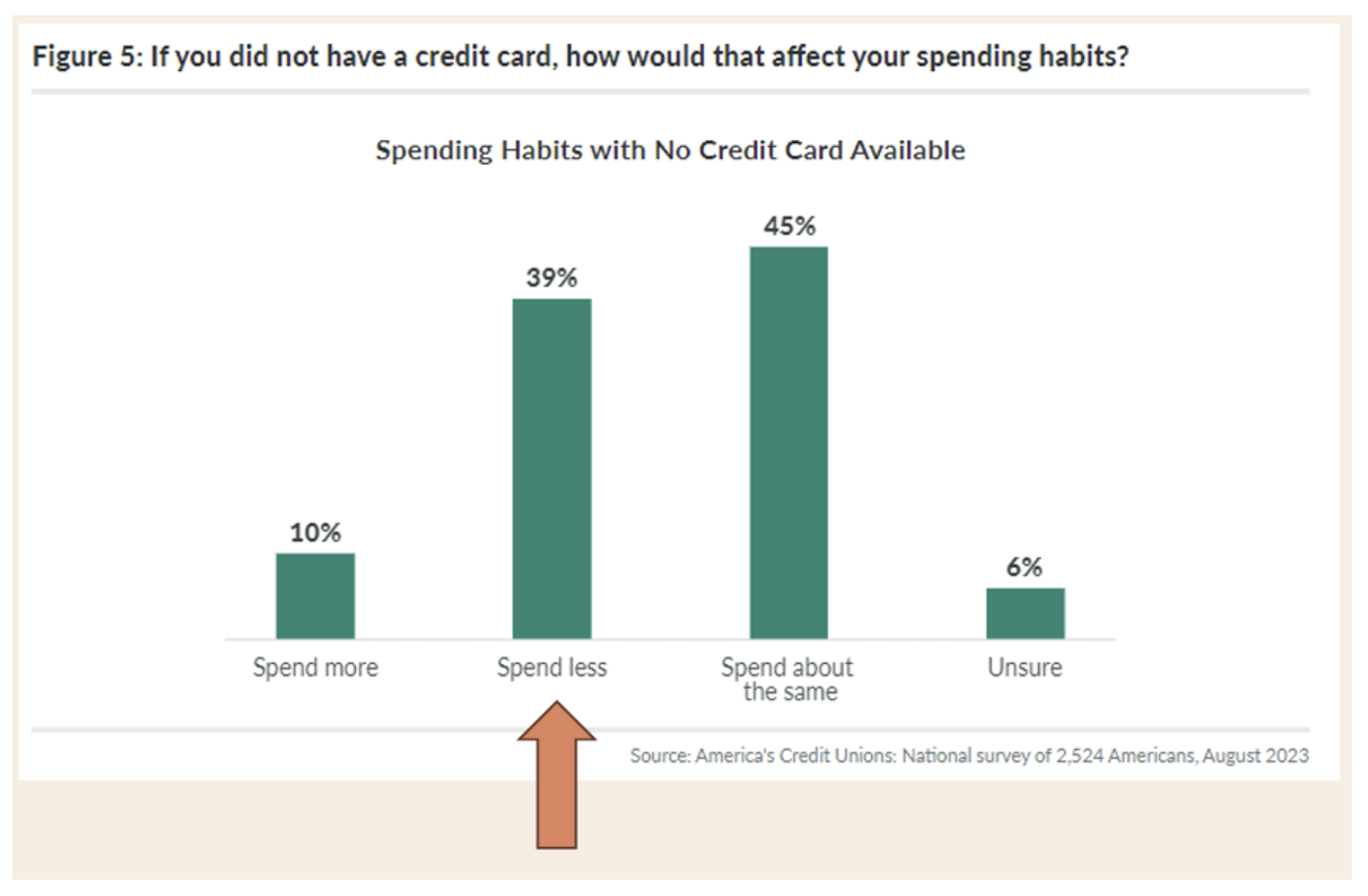

The retailers should be careful of what they wish for. A recent survey asked Americans what would happen if they didn’t have access to a credit card. Four of 10 respondents said they would spend less. So, how will that help retailers?