Whoops. In our long list on Thursday of the very impressive policy victories in the One Big Beautiful tax bill, we left out that the estate tax relief of 2017 is expanded and made permanent.

Our friends at the Family Business Coalition informed us over the weekend that the new law “increases the estate and gift exemptions to $15 million per individual and $30 million per couple, indexed for inflation. This change is made permanent.”

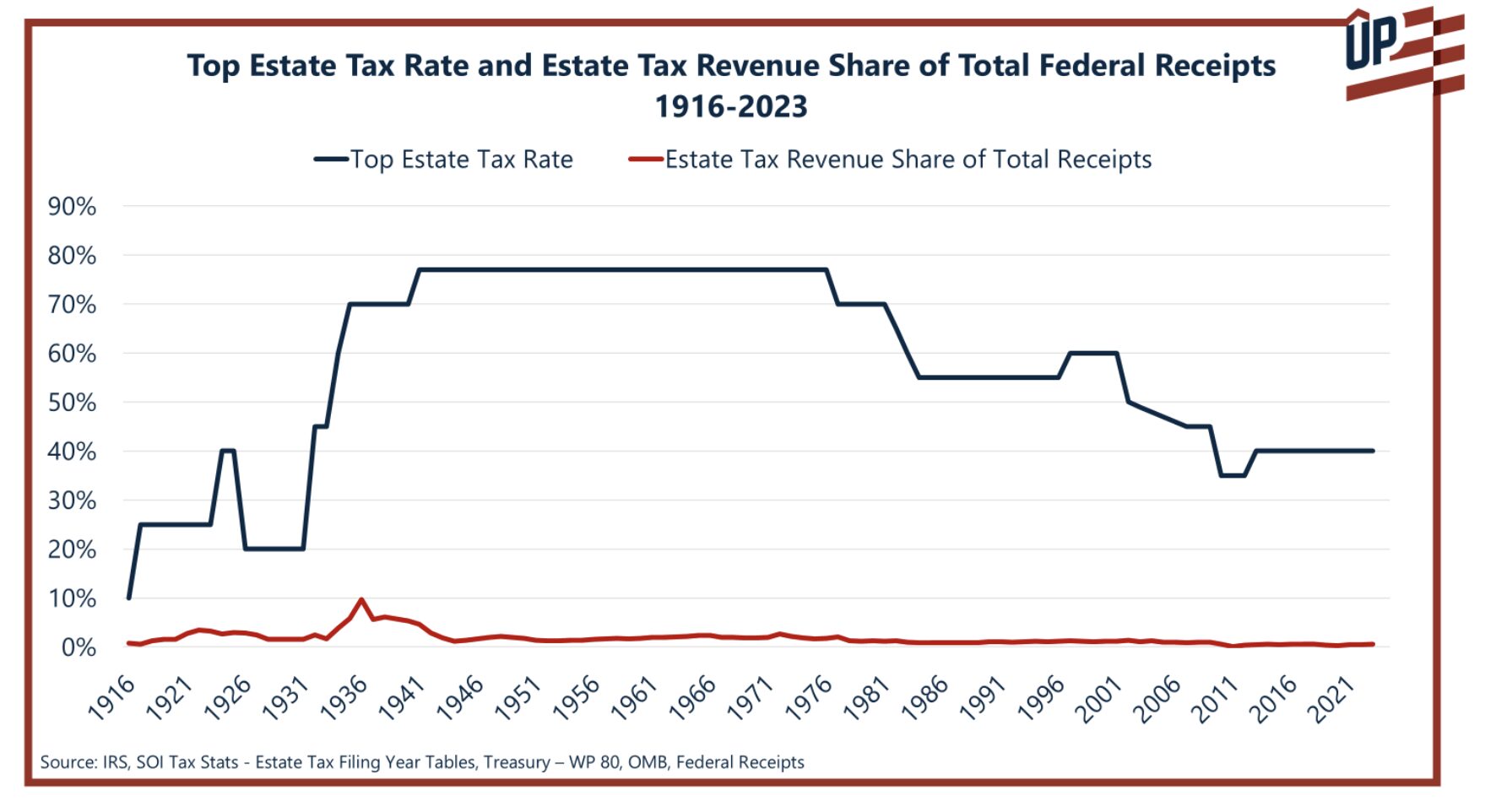

Of course, the correct rate of tax on estates is zero, since the money has already been taxed when the heir was alive. But we’re making progress. In 2001 the exempt amount was just $675,000 (about the cost of a medium-sized home) and the rate was 55%. Today, the rate is 40% with the much larger exemption.

This dumb and immoral tax raises just 1% of federal revenues, and the super rich, like Jeff Bezos and Bill Gates, will never pay a penny. That’s why even when the rate was as high as 80% it didn’t raise any money!