This bad idea never seems to die, probably because the Big Box retailers are enamored with the idea of the government juicing their margins by forcing down swipe fees. We expect a vote on the misnamed “Credit Card Competition Act” soon as an amendment to pending stablecoin legislation.

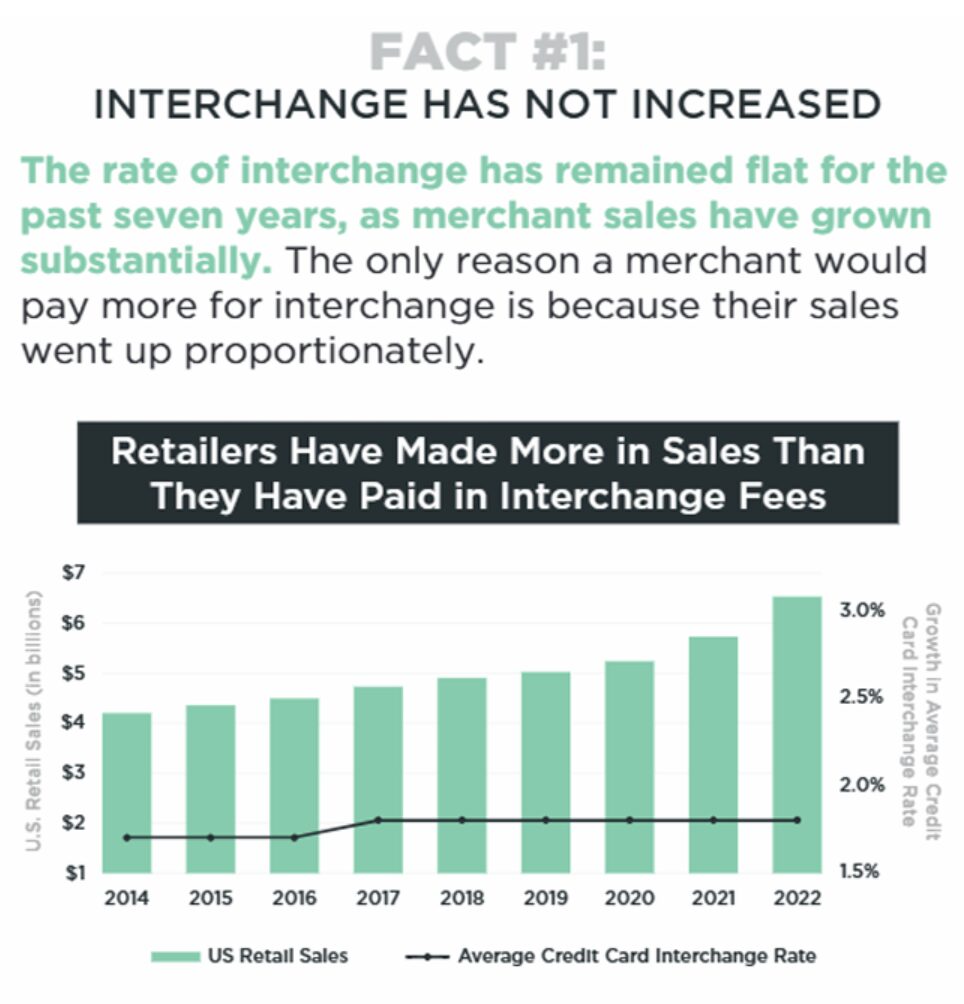

Proponents of the amendment point to rising transaction fees IN DOLLAR TERMS, even though that increase has been entirely a product of rising transaction volume.

As we explained in our 2023 paper on this issue, Federal Reserve research shows credit card issuers actually have NEGATIVE margins on their transaction, paying out MORE in rewards than they collect in fees:

Credit card companies use rewards and cash back programs to build customer loyalty and expand their share of cardholders. They are willing to take a loss on their transaction services if they can expand their credit services that account for the bulk of their profitability. But they would have no need to offer such rich rewards to consumers if they weren’t trying to bid them away from their competitors. The negative profitability margin that credit card companies incur from keeping interchange fees stable and increasing rewards to their customers is robust evidence of fierce competition in the credit card market.

We would have hoped by now that politicians would have learned one of the iron laws of economics: government wage and price controls are always and everywhere a bad idea.

Ironically, the same retailers who want Uncle Sam to set prices on credit card fees lead the charge against minimum wage and mandated worker benefit laws.