Trump is threatening to take away Harvard’s nonprofit status. That’s a good start, but why not tax ALL non-profits, or at least the ones with more than $1 billion in assets that are not true charities?

Private colleges and other wealthy nonprofits (such as the Gates Foundation, with an endowment of over $75 billion), trade associations, and hospitals are businesses pure and simple.

The non-profit exemption is the biggest leakage in the tax base, and taxing them would allow income tax rates to be cut by as much as 15 to 20%.

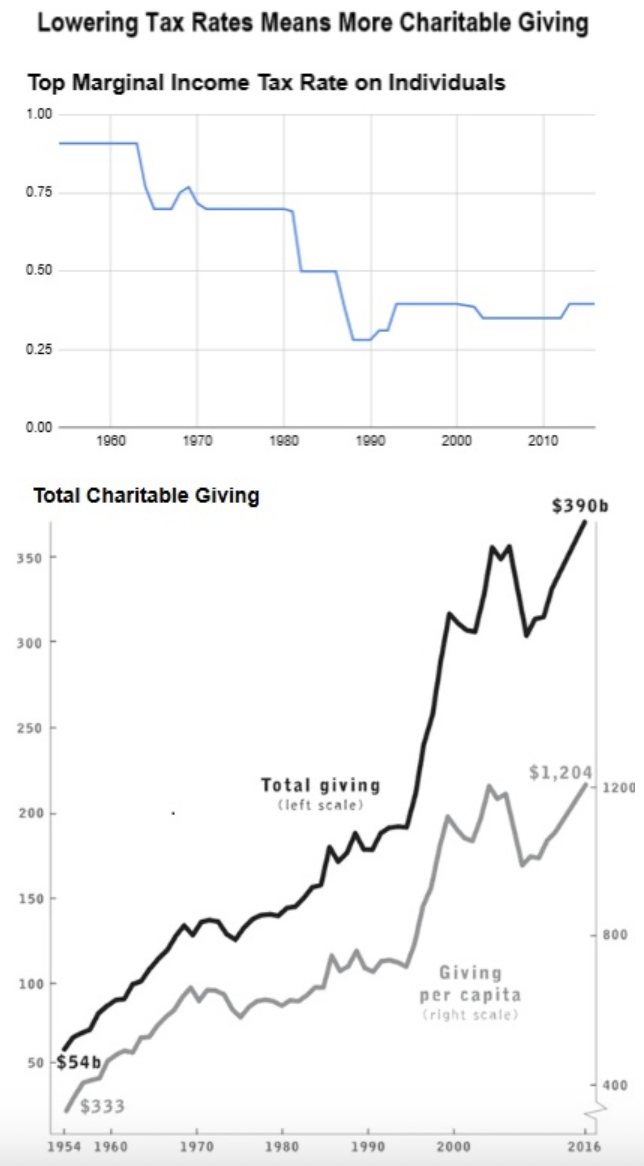

The argument against taxing nonprofits is that it will reduce the good work that charities do. Wrong! Decades of data strongly suggest otherwise. In 1954, the top federal income tax rate was 91 percent. Legislation in the 1960s, the 1980s, and 1990 reduced it to 31 percent by 1991.

But even with the reduction in the tax rate (and thus the loss in the value of the tax write-off), Americans have steadily increased their charitable contributions from $54 billion in 1954 (in 2016 dollars), to $390 billion in 2016, and then to $557.1 billion in 2023.

Giving rises when the economy is strong and the economy is strongest when tax rates are lowest.