In the last fifty years, California has done ONE thing right. In 1978, against the advice of almost all the politicians in BOTH parties, almost two-thirds of CA voters approved Howard Jarvis’s Proposition 13 – which constitutionally capped runaway property rate increases. This tax revolt launched the big California Miracle of the 1980s and 1990s. Of course, thanks to the highest income and sales taxes in the country, California’s economy has stalled out, and now there are renewed calls from Democrats to repeal Prop. 13.

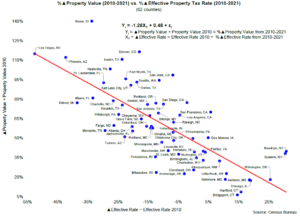

A new study by Laffer Associates and CTUP shows the damage of property taxes. When property taxes rise, home values fall because the higher taxes get capitalized into the value of the house.

The table below shows where property taxes are highest and lowest across the U.S. Amazingly, the northeastern states, which are calcifying, impose property taxes that are as much as TEN TIMES higher than in the southern states. New Jersey, where the average single-family-home property tax hit $9,500 in 2022 compares with the average of $928 in West Virginia and $1,022 in Alabama.

The government unions say that high property taxes are associated with better public services and schools, but that is a lie. New Jersey and Illinois have the highest property taxes and are very near the bottom in the quality of public services.

Several states, including Tennessee, are now examining Proposition 13-style property tax caps. Yes, it is time for another revolt among homeowners across the country.