Our friends at the Institute for Energy Research make a compelling case:

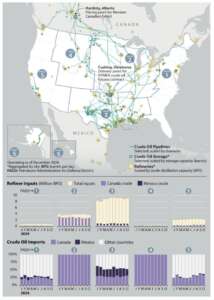

A proposed 25% tariff on imports from Canada and Mexico would seriously disrupt the supply chain U.S. refineries rely on to produce the fuels and petroleum products Americans use every day. Even with upgrades to existing infrastructure, many refineries simply aren’t built to accommodate such a significant tariff on Canadian crude. Given the long timelines for planning and permitting the necessary changes, plus the fact that refineries depend on refining margins to stay profitable, it would take several years for refineries to adapt to the changes in oil trade flows brought about by these tariffs…

Patrick De Haan, head of petroleum analysis at GasBuddy, told Marketwatch in November that gas prices could rise by 30 to 40 cents per gallon, and possibly as much as 70 cents, once the tariffs take effect. This increase could occur within days of the tariffs being enacted, with the most significant impact in the Midwest, given its reliance on Canadian crude.

President Trump and leaders in Congress should be careful not to let trade policy undermine their North America energy dominance agenda.