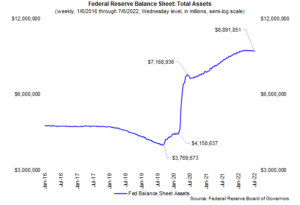

We keep hearing that the Fed is reducing its near $9 trillion balance sheet. But here is the latest chart from Laffer Associates. This looks to us like the peak of Mt. Everest.

Most of these trillions of dollars of “assets” are Treasury bonds, but there are also an estimated $1 trillion in mortgage-backed securities in the Fed portfolio.

Rather than raising interest rates directly, we’d prefer the Fed to stop distorting credit markets by buying up treasury bonds and mortgage-backed securities. These direct interventions into markets by the Fed distort investment decisions. Instead the Fed should start selling off these bonds. This will raise interest rates for sure, but the bond-selling should continue until inflation gets below 4% and hopefully closer to the 2% Fed target.