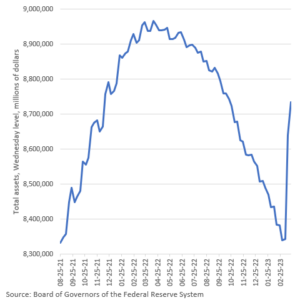

The Fed rolled off $3.5 billion in mortgage-backed securities last week but loaned out $60 billion in repurchase agreements OVERSEAS, made another $36 billion in loans largely from the new emergency fund, and had other small contributions from various lending facilities. Add it all up and the Fed grew its balance sheet again last week, wiping out more of QT. The Fed is now paying big banks, hedge funds, etc. $700 million every day to keep a record amount of cash parked at the Fed, while regional banks continue to bleed deposits. That’s costing taxpayers, but it’s also cutting out the middleman – the Fed is turning itself into a direct lender, increasingly bypassing banks.