Fed Chief Jerome Powell made it clear that the Fed will cut interest rates in September (perhaps by 50 basis points, given the lousy jobs report today).

Usually, one rate cut is followed by a succession of others. Investors are drooling at the prospect, but rate cuts may not be the deliverance Wall Street is expecting.

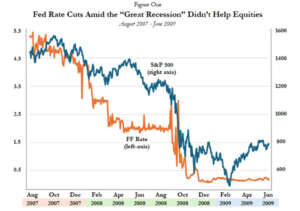

An analysis by Richard Salsman of InterMarket Forecasting finds that rate cuts aren’t always bullish. In the graphs below, he shows that rate cuts happened at the start of three of the worst sell-offs in recent times. That includes the bear market of 1973-74, the tech bubble bursting in 2000, and the Great Recession of 2008.

These three episodes may be historical aberrations, but they certainly call into question the power of the Fed to make everything alright when there are structural problems with the economy – as we have now.

Our view is that the best approach to conquer stagflation is with Pro-growth tax policies, combined with hundreds of billions of spending cuts.