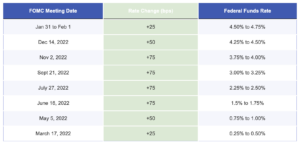

The Fed has raised interest rates eight times in the last year from near zero to 4.75% now. Our best guess is they will hike again to 5% today or tomorrow.

As we’ve seen in recent weeks, these rate hikes have caused some turmoil in the banking industry as higher rates have lowered the value of long-term bond holdings of banks.

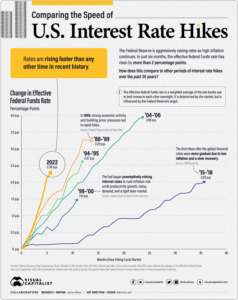

As the chart below shows, these have been some of the most rapid rate increases in American history. From zero to 500 basis points in just a little more than a year. What do they think the U.S. economy is? A Ferrari?

These rate hikes are a painful reminder that inflation is financial cyanide. Our politicians seem to have collectively suffered economic amnesia – and forgotten this lesson from the last bout of runaway inflation under Nixon, Ford, and Carter, which ended in a stock market freefall and a mini-depression.

What we are witnessing now is the cleanup job the Fed must engage in to unwind from the crackpot Biden Modern Monetary Theory. This was the notion that we could send federal spending and borrowing into orbit with no negative consequences because the dollar is the world reserve currency. Some $6 trillion has been spent and borrowed since Biden came into office – one of the largest and anti-growth transfers of resources from the productive private sector to the unproductive government sector has been an abject failure for all to see. The pain of wringing all of this excess liquidity in the market is just beginning and will last many years– unfortunately.

Sorry, Joe. Milton Friedman was right: there is no free lunch.