Biden is still pushing his gambit to tax unrealized capital gains – i.e., the appreciation of stock and other assets – even when they are not sold and there is no actual “gain.”

Republicans should counter with a proposal to index capital gains for inflation. Senator Ted Cruz of Texas has introduced legislation to do just that.

For the past three decades the inflation tax on stock and business sales hasn’t been much of an issue because inflation has been so low. But now with consumer prices rising at 8.5% it’s a big tax hike on stock ownership because an increasing share of investor gains are due to inflation. For example, we showed last week that even though the stock market and company earnings were up last year in nominal terms, when accounting for inflation, most stocks lost money.

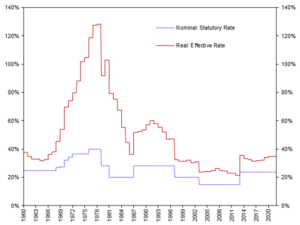

The chart below from CTUP co-founder Arthur Laffer shows that the effect of high and persistent inflation in the 1970s pushed the tax rate on REAL gains to 100% or more. In other words, investors paid a tax on real capital LOSSES. Almost everyone would agree this is unfair and bad tax policy.

As a matter of tax fairness it is time to let investors index for inflation.