The White House is getting desperate. We noted earlier this week that Joe is airdropping tens of billions of dollars of pork spending into toss-up states.

But that’s chump change compared to the latest stimulus scheme.

The Biden administration wants the federal government via Fannie Mae and Freddie Mac to provide taxpayer backing for home equity loans. Talk about mission creep. These agencies are supposed to support homeownership – not juice consumer spending.

Home equity loans — or second mortgages — use the equity in the home as collateral for quick cash. We have nothing against them. But how in the world is this in the interests of taxpayers?

It isn’t.

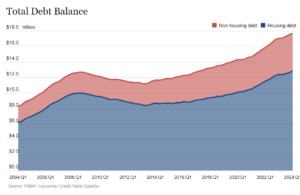

It’s especially inappropriate at a time when Americans are already over-leveraged up to their eyebrows. Have the Biden brainiacs looked at the record-high credit card debt of over $1 trillion? Overall total household borrowing has reached an all-time $17 trillion. The last thing the feds should be doing is encouraging more debt.

Our friends at the Wall Street Journal last week cited Bank of America analysis projecting that this move would unleash $1.8 TRILLION in new borrowing against home equity – which could start pouring in later in the summer. Perfect timing for Joe to resuscitate his campaign.

The Biden housing experts tell us that this won’t cost taxpayers a penny. Sure. Let us remind readers that‘s what Fannie and Freddie told us before the housing bubble burst in 2008. Oops. The biggest taxpayer bailouts went to Fannie and Freddie.

This is arguably one of Biden’s most dangerous, reckless, and cynical ideas to date – but there are so many to choose from and undoubtedly more to come.