Everyone knows that gold is the ultimate hedge against inflation. In the 1970s as inflation surged, gold was about the highest-performing asset rising from $30 to $300 an ounce while the stock market crashed.

But over the past 40 years, Gold (and silver) has been about the worst-performing asset dwindling in value relative to stocks. Stocks have skyrocketed by nearly 40-fold since 1980 whereas gold has risen only about sevenfold. Gold has only done well during temporary periods of crisis, such as the 2008 financial meltdown and the Covid outbreak in 2020.

Why has gold done so poorly? In large part because of the strong and stable dollar – which was returned to being, as Reagan put it, “as good as gold” during this magical four-decade (1980-2020) run of American global prosperity and dominance.

https://www.longtermtrends.

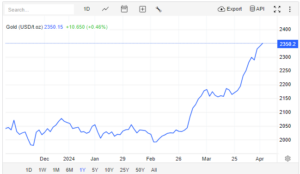

Which brings us to the last six months. Gold is rising again and is up 16%. Maybe this is just a blip. Or maybe it’s a sign that inflation is back on the rise and that the fundamentals of the economy are a lot weaker than Washington is pretending them to be. Either way, a rising gold price is a bad sign.

https://tradingeconomics.com/commodity/gold