Well maybe the members of Congress are reading and digesting the Hotline after all. We’ve been the loudest voices arguing for offsetting pro-growth tax cuts in the Trump 2.0 plan with taxes on endowments with more than $1 billion. These giant, never-taxed treasure chests serve no public purpose and only make the rich richer.

So we were thrilled by this headline announcement from yesterday:

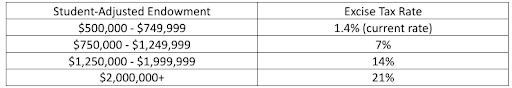

The revenues are smaller and more targeted than we would like to see. The GOP plan would impose a top tax rate of 21% on the investment earnings of the endowments for schools with more than $2 million per enrolled student:

That’s a good start. But we also want to see a one-time excise tax of 15% on the endowments. Then, in the future, donations to universities with budgets over $1 billion should no longer be tax deductible. This would raise more than $100 billion and help pay for ending the unfair tax on Social Security benefits.

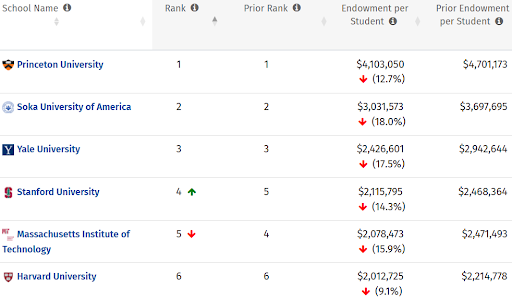

As a useful reminder, here are the schools that would be in the top rate under the House bill: