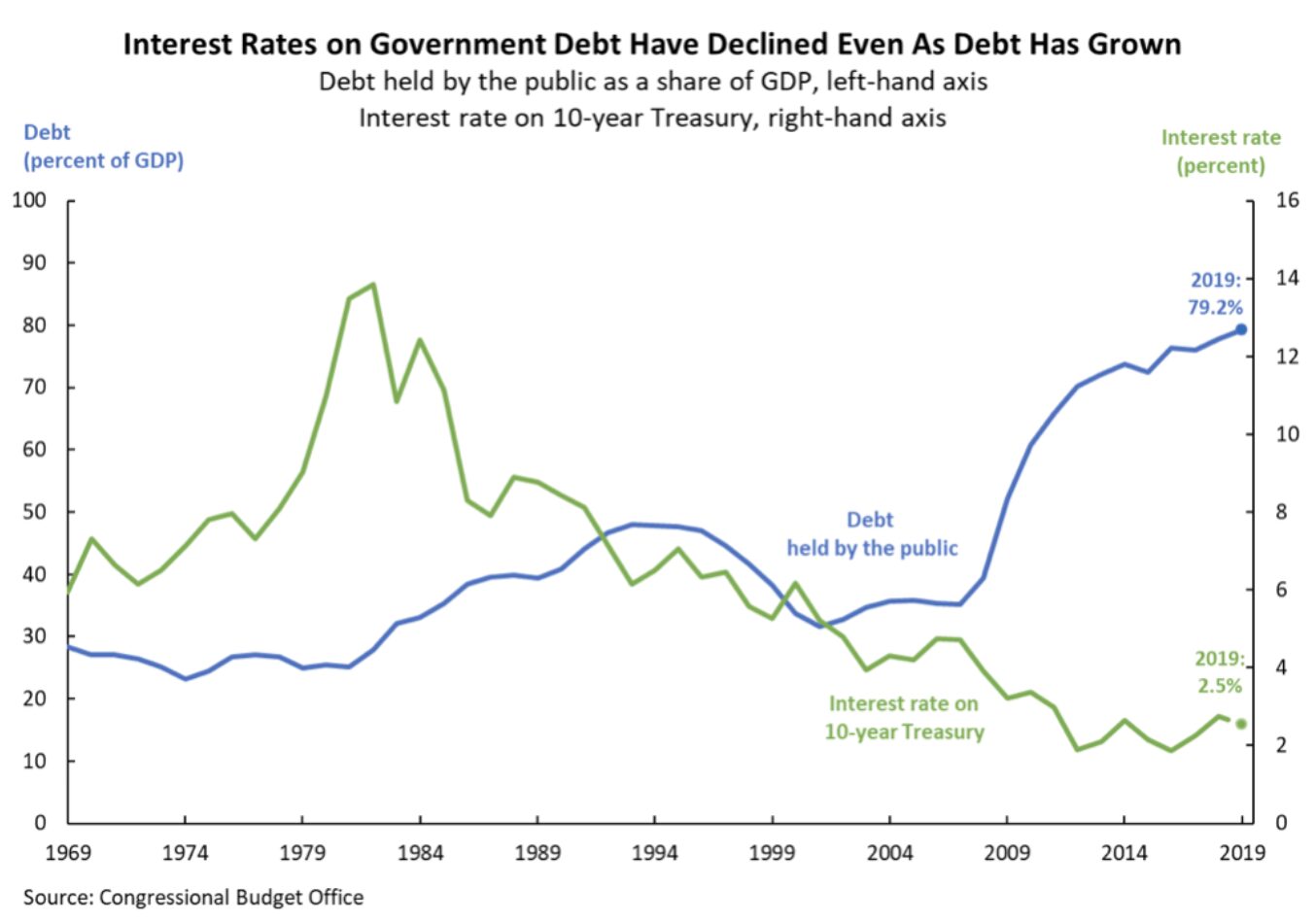

Government budget deficits are bad things and we’d love to see the budget balanced. But one of the lessons we learned in the 1980s was that government deficits do NOT cause higher inflation or higher interest rates. The deficits went up and yet the interest rates and inflation came WAY down.

This chart is a useful reminder:

How can that be? Because it is not government BORROWING but government SPENDING that crowds out private savings and production. This is why raising taxes is no economic solution to the spending free-for-all that created the mountainous $38 trillion national debt in the first place.