We were delighted by the many comments, criticisms and praise regarding our lead HOTLINE item yesterday on how the Smoot-Hawley tariffs were the match that lit the fire of the 1929 stock market crash and the decade-long collapse of the economy.

This was an oversimplification.

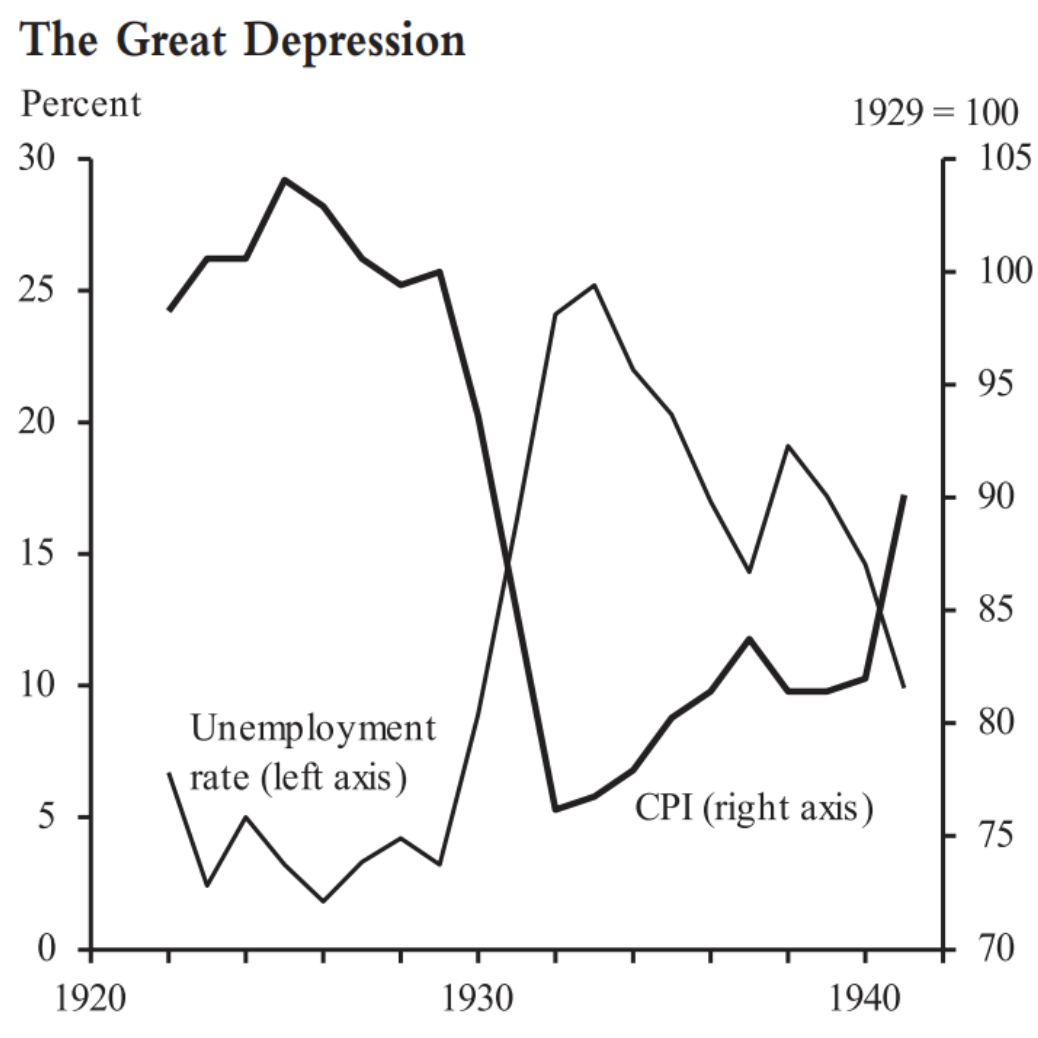

As Milton Friedman and Anna Schwartz taught us in their classic book “A Monetary History of the United States,” the money supply dramatically contracted after October,1929. This severe shortage of money contributed mightily to the unemployment rate hitting 25% and staying above 10% for a decade.

This is why today we don’t want to see prices fall in the aftermath of Bidenflation. We want prices to be stable.

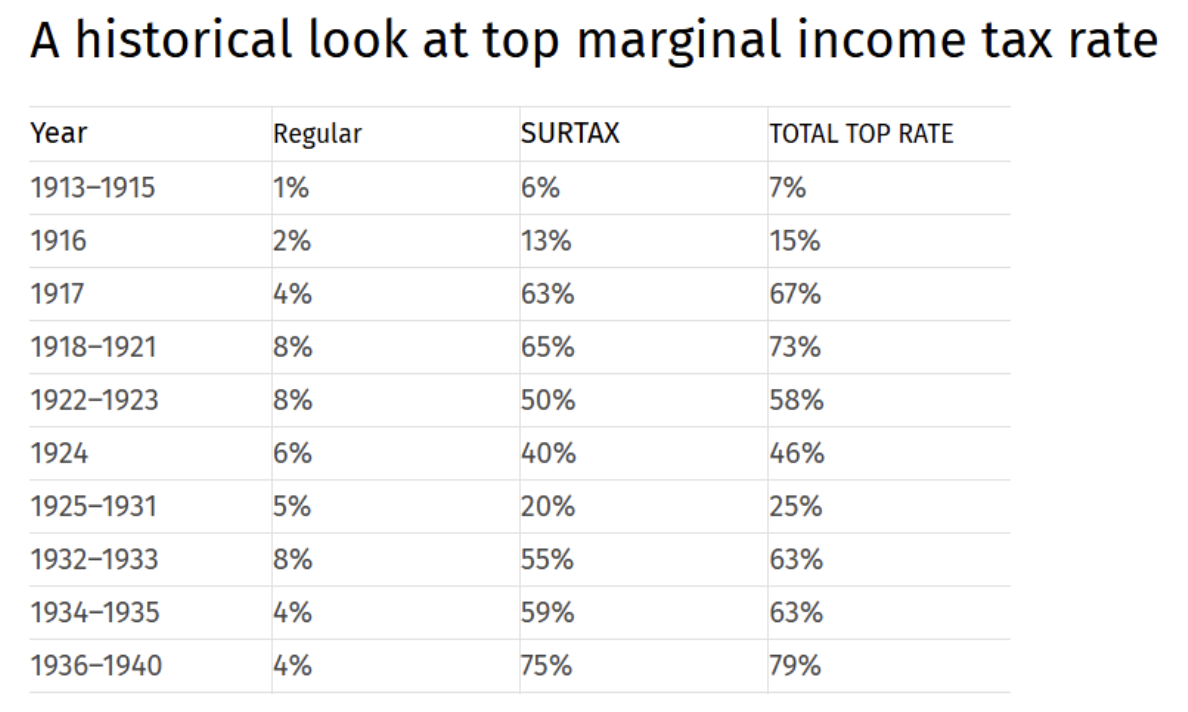

The other factor that turned what should have been a brief financial panic into the Great Depression was that in one of the greatest acts of economic malpractice in American history FDR raised the highest income tax rate from 25% under Coolidge to 79% in 1936. The economy crashed and burned.

It was tariffs, deflation, taxes, and New Deal government spending that wrecked the prosperity of the Roaring ’20s.

Let’s not EVER do that again.

And keep the comments coming. We read them all!