As regular HOTLINE readers know, Unleash Prosperity has dominated the debate over ESG proxy voting by the big investment firms. The report which we began publishing three years ago and which is available at PensionPolitics.com has moved these firms dramatically away from ESG nonsense.

Our newest report grades the state pension funds on how they vote on ESG shareholder resolutions. These funds control trillions of dollars of shares of stock.

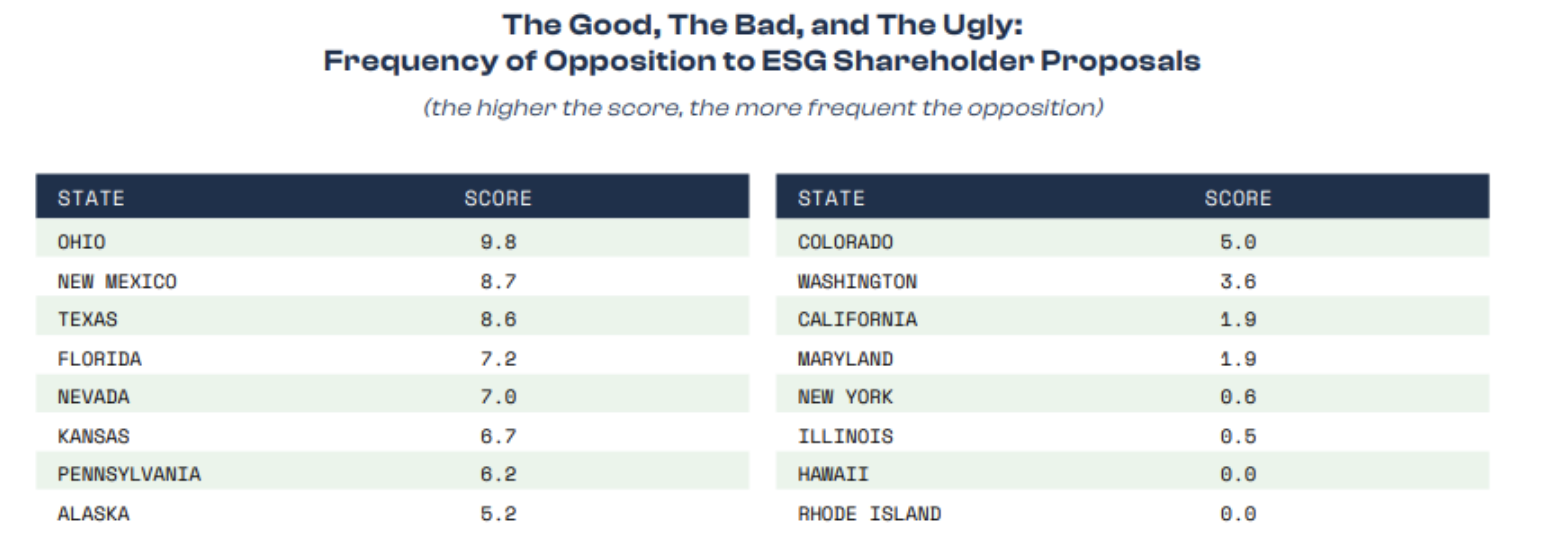

We wanted to score all 50 states, but most states refused to provide us with data. In the chart below, the best states are on the left and the worst states on the right.

State financial officers with oversight of these pension funds have a fiduciary obligation to earn the highest risk adjusted return possible. But our report finds that many state-run public pension funds are supporting radical activist proposals – which are often hostile to company and shareholder interests.

The New York Post covered our latest findings, and noted that US Rep. Andy Barr has proposed legislation that would require pension funds to invest solely based on financial objectives.

The full paper is available at PensionPolitics.com.