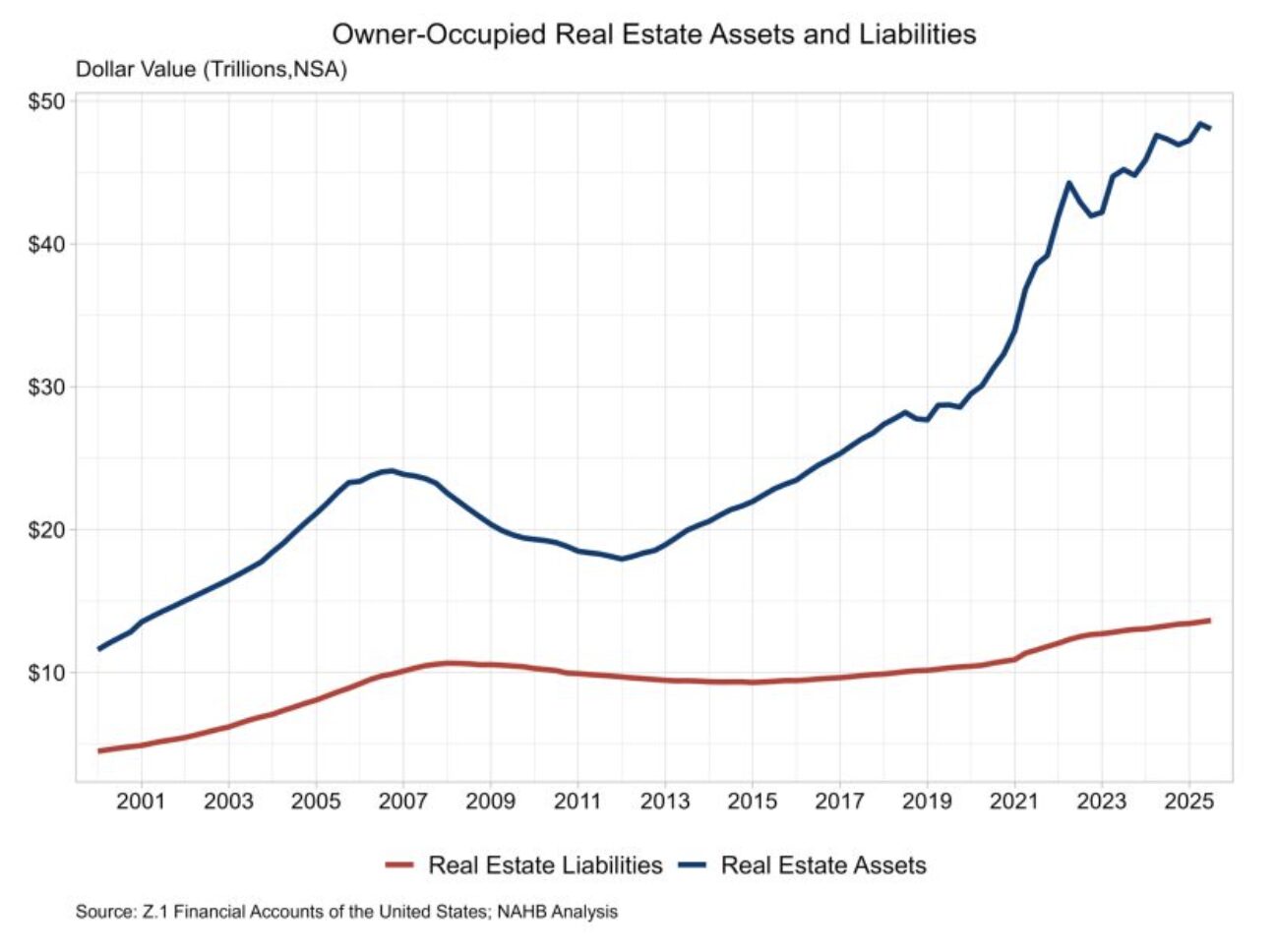

Good news: The market value of owner-occupied housing in America is now just over $50 trillion. That number has quadrupled since 2000 and doubled since 2015 (not adjusted for inflation).

Even better news: The owner equity share of that $50 trillion has steadily risen to 72% (up from 48% just 10 years ago). The remaining 28% is owned by lenders and investors. This means that Americans directly own nearly $35 trillion of the housing stock. We are a VERY rich nation.

The big housing mystery is why aging baby boomers and empty nesters haven’t cashed in on that equity and sold their homes to the younger generation – effectively, their children.

Answer: because they can’t afford to sell because the capital gains tax owed would be so high. They are locked in. Instead, the boomers sit on the homes like a mother hen and wait until they die to avoid paying the tax.

So we will say it again: Congress can alleviate the housing affordability crisis for young people by indexing the capital gains tax on residential property. This will raise money for the government and dramatically increase the supply of houses for sale, as Jeff Yass and Stephen Moore argued weeks ago in the WSJ.