We noted here in the Hotline on Monday that cutting Social Security benefits is political suicide for Republicans and that the problem with Social Security is that the benefits paid out to retirees are WAY too low, not too high.

We also promised to outline a much better plan for today’s workers, rather than raising the 12.4% payroll tax and cutting promised benefits – which forces them to pay more in and get less out. What kind of a deal is that?

Under the “Own America Account” plan first outlined in the Wall Street Journal by Stephen Moore and Jeff Yass, workers would be given the option of having their payroll tax payments placed into a personal 401k-type account with the money invested in an index fund of stocks and bonds. Every worker in America would now become a part owner of every publicly traded company in America.

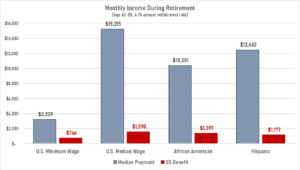

We have just updated the numbers. If we had adopted this system 40 years ago, the average retiree today would be receiving a monthly benefit not of $1,800 a month, but $5,000 to $10,000 a month.

Almost all workers who worked 40 years or more full-time would not only have much more retirement income, but likely would have been able to leave an inheritance of well over $1 million to their children at the time of death.

Some might argue that the stock and bond market is too risky. Wrong. Stocks are risky in the short term, but safe in the long term. Even if we take a worst-case scenario and pick the worst 40-year period for stocks in American history (1969-2008) and (1929-1958), workers would do substantially better than what Social Security promises:

This would also do more to reduce income and wealth inequality in America than virtually any other policy. This is because the current payroll tax denies lower-income Americans the ability to accumulate ownership and wealth. The lower the income of a worker, the more their economic situation improves by having an “Own America Account”, and the more we lower the “wealth gap” between rich and poor.

The chart below shows how much of an inheritance a senior citizen could pass on to their children or grandchildren, based on life expectancy for each demographic group:

Wouldn’t this run up the national debt as the government would be forced to borrow more to pay the benefits to current senior citizens that are now offset by current workers’ payroll taxes?

No, for two reasons. First, every dollar in additional federal borrowing in the short term would be offset dollar for dollar with a reduction in future benefit obligations and higher savings by American workers’ deposits into the “Own America Accounts”. This plan involves no NET reduction in national savings.

Second, the plan would wipe out more than $20 trillion of unfunded Social Security liabilities (the excess of promised benefits over payroll taxes collected).

The “Own America Accounts” would constitute 1) the largest debt reduction plan in history; 2) the biggest tax cut for workers in American history (because workers now get to keep in a personal account what they currently pay into the Social Security black hole); and 3) the greatest wealth accumulation opportunity for every income and racial group ever invented.

It almost makes too much sense.