Last week we showed that commodity prices are soaring and we reminded readers that this is a lead indicator of higher consumer inflation. (The commodity index is now up 15% since the start of the year.)

We got lots of responses on that, including from our friend and investment ace Scott Grannis. Scott is predicting moderate inflation over the rest of the year due to slow monetary growth. This is a more traditional monetarist view of inflation, and it’s worth paying attention to.

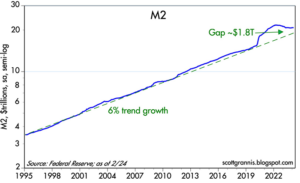

Scott notes that M2 (the Fed’s favored definition of the total supply of money in the economy) continues to shrink as a share of the economy. After the explosive growth of M2 in 2020 and 2021, M2 has been slightly negative and it has returned to its 6% trend growth.

As his chart shows, M2 growth has been a reliable predictor of inflation with about a one-year lag, and if that relationship holds up, inflation will start to fall.

That’s a big IF, and given the continued torrent of government spending expected this year and next, we still think it’s going to be hard to stop the rise in prices.