We’re asked every day by readers where we think inflation is headed. All we can do is report to you the market’s most important forward-looking indicators of prices. Right now, they’re all pointing in the direction of inflation falling to the 3 – 5 percent range in the months to come. Remember, we were the ones who last summer accurately forecast an inflation retreat. Here again, is an update on the inflation indicators we think are the best predictors:

-

-

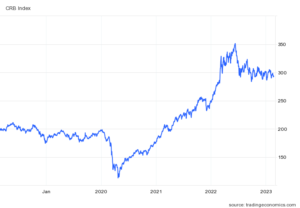

- Commodity Prices – They’ve come down from their highs last summer and have remained steady for the past six months. Since the early summer of 2022, the CRB index has fallen by about 15%. No sign of inflation here.

-

-

-

- Gold Price – Gold is known as the ultimate hedge against inflation. During the 1970s gold prices skyrocketed by almost 10x as inflation soared from 2 to 13% under Nixon, Ford, and Carter. The gold price has stayed fairly steady at a range of $1,800 to $1,950 an ounce for the past year. Since the start of the year the price has been flat and over the past two weeks the price has fallen from $1,950 to below $1,850. (Might be a good time to buy gold!) For now, there is no hint of inflation in the gold price.

-

-

-

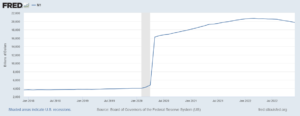

- Money Supply – Regular readers know the story here. During the pandemic in 2020 and 2021, the money supply exploded (which unleashed inflation) but over the past year, M1 growth has been flat and slightly negative. Of course, there is still a huge excess of money sloshing around in the economy from the 2020 avalanche of dollars and runaway government spending.

-

-

-

- TIPS Spread – The best market indicator of inflation is the 5 or 10-year Breakeven Inflation Rate on inflation on a government bond. You can see that rate fell from 3.6% this time last year to 2.6% now. But beware: over the last six weeks the rate has risen from 2.1% to 2.6%.

-

All of this suggests to us that inflation is still a lingering threat, but the worst is well behind us – for now. Congress can help by cutting $1 trillion out of government spending.