This headline from the New York Times seems almost surreal to us. She’s urging House Speaker to raise the debt ceiling to avoid a federal default?

Madam Secretary, just to recap: the House already DID vote to raise the debt ceiling late last week. Were you abroad at a climate change conference? The chamber that hasn’t raised the debt ceiling is the United States SENATE. Last time we checked, that body is ruled by Democrat Chucky Schumer.

Biden’s media team warns that failing to raise the debt ceiling will cause a deterioration of America’s credit rating and raise the cost of federal borrowing. Possibly. But does the Biden Administration really want to run with this argument? When Biden came into office, the federal fund’s interest rate was close to zero and the cost of federal borrowing was seldom in modern times lower.

Today, the federal funds rate is 5% and soon to be 5.25%. (Remember: The Fed raised these rates to fend off the inflation that was incited by Biden’s $6 trillion spending and borrowing spree.)

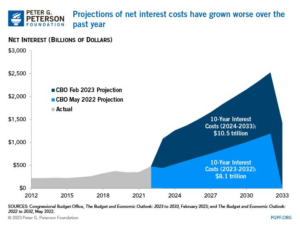

Interest payments are now expected to be more than $2 trillion higher over the next decade since Biden came into office and opened the trough.

Raising the debt ceiling won’t prevent the deterioration of our government bonds. Only cutting U.S. government spending and growing the economy will accomplish that.