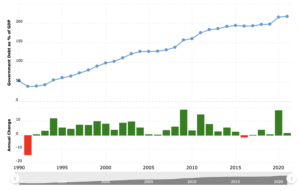

If there is any country in the world that has rolled the dice on Modern Monetary Theory (more than the Biden government here at home), it is Japan. Once the paragon of fiscal restraint and balanced budgets, Tokyo abandoned that strategy in the 1990s in favor of a Keynesian plan of “stimulating” the economy with massive government spending and borrowing. Over the last 30 years Tokyo has run up its gross debt from a manageable 50% of GDP to more than 200% of GDP today. Japan has by far the largest debt burden of all advanced economies.

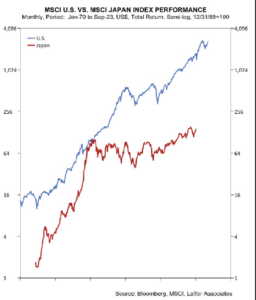

How is this working out for them? It is true that this tidal wave of debt has NOT caused much inflation of the Yen. But what it has coincided with is a flatlining of the Japanese Nikkei stock market index. Malaise.

Here is the latest depressing news flash on the state of Japan’s economy from Nikkei Asia:

“Germany’s nominal gross domestic product is likely to overtake Japan’s this year, with Japan’s nominal GDP falling 0.2% year-on-year while Germany’s expands 8.4%. In 2000, “Japan’s economy was the second-largest in the world, at $4.96 trillion, which is larger than it is today. At the time, its economy was 2.5 times bigger than that of Germany and 4.1 times bigger than China’s.” (Nikkei Asia) Now it is smaller than both.”

Japan’s three-decade long stagnation is a cautionary reminder that government spending doesn’t stimulate growth and runaway government borrowing is no path to prosperity. Someone tell the White House before it is too late.