Quick history lesson:

When the founders of the Committee to Unleash Prosperity (Laffer, Kudlow, Forbes, and Moore) advised Donald Trump back in 2016 on tax reform, we recommended a 20% corporate tax rate, because the U.S. rate of 40% (when including state taxes) was the highest in the world. This incentivized capital to flow out of the U.S. to leverage lower tax rates in Europe and Asia. We predicted and Trump agreed that this policy would lead to more jobs (it did), more capital flows into the U.S. ($1 trillion came in), and higher wages for workers (biggest wage gains in 20 years).

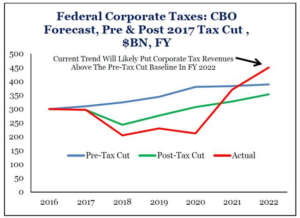

What we didn’t expect was the gusher of tax revenue INCREASES with the lower rates. Our friends at the Wall Street Journal editorial page broke this story last night that revenues have been HIGHER after the corporate rate cut than they were before the cut. AND the revenues were higher than the bean counters in Washington predicted. See chart.

The Laffer Curve strikes again. But facts like these don’t seem to matter to the progressive Bidenites. The White House and Bernie Sanders are still pushing a 28% corporate rate hike. These are the same people who say “follow the science.”