Consumer prices are now officially up just over 20% since Biden entered office. This is a dreadful record of fighting inflation and it is no wonder that voters are angry and anxious. Biden’s record on controlling prices is the worst since Jimmy Carter.

The good news is that price rises are finally starting to moderate, as reflected in the latest CPI report. Where are we headed?

We like to look at four key forward indicators of inflation and they are all pointing to inflation in the 3.5% range over the next year or so. Remember: the Fed target is 2%.

Commodity Index

This one is troubling. The real-time index of commodity prices shows the composite price of everything from copper to cotton to coal is still on the rise and near a 10-year high. This suggests that we are likely to see a worsening inflation picture in the weeks ahead.

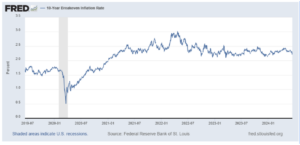

Ten Year Break Even Inflation Rate TIPS Spread

This remains low. It shows that investors believe that over 10 years inflation will be running at a tame 2.2% rate.

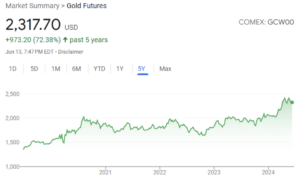

Gold Price

The gold price had spiked up to above $2,400 an ounce earlier this year, but in recent weeks, has drifted down to $2,317. Still, this is near a 10-year high, suggesting that investors are still buying gold as a hedge against runaway inflation.

Ten Year Treasury Yield

Investors are buying the Ten Year Treasury at an interest rate of 4.25%, which is down from a peak of near 5%, and suggestive of only moderate inflation on the medium horizon.