We still don’t know why so many Wall Street economic geniuses predicted that the GDP report would show a positive number, given that inflation is running at 9%.

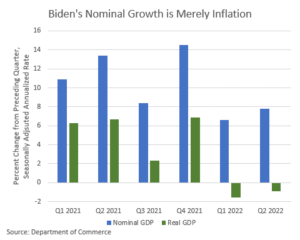

Consumption grew a mere 1.0% but it was fueled by people continuing to dip into savings, not rising real incomes. Real disposable incomes and savings continued their freefall. Investment utterly collapsed in the second quarter, falling 13.5%. Nominal output rose (as shown by the chart below) but real output and incomes fell. Investment collapsed by 13.5%. That’s a leading indicator, so recovery is not around the corner. Strap in!

We are calling this a “Disposable Income Recession,” because all the pain in the purchasing power of the typical family is down roughly $4,000 this year relative to wages and salaries.