Here’s a headline on chipmaker Nvidia’s astonishing ascent:

Shares of Nvidia rallied to record highs on Wednesday, with the AI chipmaker’s stock market valuation on the verge of hitting the $3 trillion mark and overtaking Apple to become the world’s second most valuable company.

Nvidia’s stock has surged 145 percent so far in 2024, with demand for its top-of-the-line processors far outstripping supply as Microsoft, Meta Platforms and Google-owner Alphabet race to build out their AI computing capabilities and dominate the emerging technology.

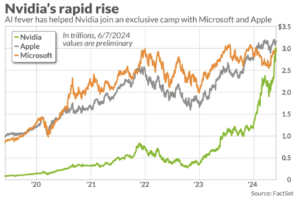

And here’s a stunning market cap chart:

Some dubbed the phenomenon “Jensenity,” a reference to the company’s leather jacket-wearing CEO Jensen Huang, who has commanded a rockstar-esque following.

Isn’t free enterprise a marvelous thing?

The worry is that Lina Khan will see these profits and scream for more antitrust action. In 2021 she and global antitrust regulators blocked Nvidia’s 2021 merger with Arm.

We live in a strange upside down world where successful companies are torn down by regulators and industries that perpetually lose money – battery companies, EVs, solar panel, some chip producers – are propped up by government.