Trump’s comment last Thursday, that he could use tariffs to eliminate the income tax, has ignited a fury on the left. We think the idea is interesting. It’s clear he didn’t literally mean the entire income tax, but some parts of the income tax could be eliminated.

But New York Times provocateur, Paul Krugman, instantly went on the attack. Here is what Krugman wrote on X:

“Tariffs would raise the cost of imports to consumers, so we’d import less, which would mean you need a higher tariff rate. But this reduces imports further, meaning a still higher tariff, and so on.” Eventually the tariff rate reaches so high there are almost no imports to tax.

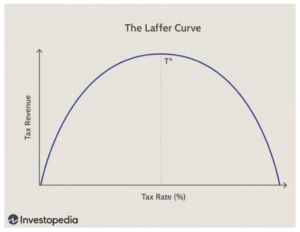

Wow!! So what Krugman has explained here is a Laffer curve effect with tariffs. The higher the tariff, the less imports we buy. The more you tax something, the less you get of it. What a concept.

Laffer’s famous curve drawn on a napkin noted that the higher the tax rate on work and investment, the less work and investment you get – and that at very high rates the tax could even produce less revenue.

Krugman has always been dismissive of the idea – but suddenly he’s an accidental disciple. Finally.

Then he asks: “So how is it that in the 19th century, the federal government largely paid its way with tariffs? Because back then the government was much, much smaller. Believing that we can go back to those days is just ignorant.”

Why? Wouldn’t the world be a better place without the modern-day welfare state?