Anyone remember back in 2008 when the housing market collapsed and the stock market crashed by more than anytime since the Great Depression? Apparently the politicians in Washington don’t.

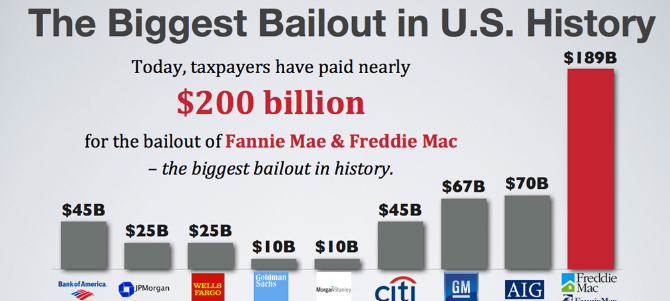

The institution that lost the most money and required the biggest taxpayer bailout wasn’t any of the major banks that teetered on the verge of bankruptcy, but Fannie Mae – the government-guaranteed enterprise that insures federal mortgages and was supposed to NEVER fail. Fannie received over $100 billion of taxpayer rescue funds.

Fannie Mae is still in conservatorship and hopefully the Trump administration will move toward setting it free and severing all its federal strings so that taxpayers don’t get burned again.

Instead, Fannie and the housing lobby want to force taxpayers to take on tens of billions of dollars of new risk by eliminating title insurance on federally-backed loans and replacing it with… ta da: Fannie Mae as the de facto insurance provider.

This reckless Biden administration plan should have received a ceremonial burial when Kamala Harris lost the election, but Fannie and the housing lobby are using their political muscle to resurrect it under Trump.

This is privatization in reverse. Taking a well-functioning private insurance market, and replacing it with government guaranteed insurance coverage. Senator Tim Scott, the Senate Housing Committee chairman is heroically fighting against it.

We can’t think of a dumber or costlier idea – which is why we are still worried.