We’ve been warning that headlines like this one from Reuters yesterday were right around the corner:

We don’t like being killjoys, but the one thing that could derail the Trump presidency right from the start would be another burst of inflation.

The Fed isn’t doing the economy or the incoming Trump administration any favors by resuming its loosey-goosey monetary policy.

We all love low interest rates – especially Trump – but inflation is headed north again. Over the past three months commodity prices are up roughly 6%, and that’s not stable money. Notice the trend in these charts:

Here is the six-month CRB commodity index reading.

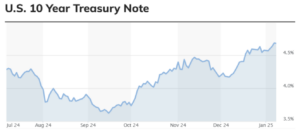

We also like to look at the 10-year Treasury interest rate. Since the Fed began lowering rates, that interest rate has RISEN by nearly one percentage point.

The gold price has held steady in recent months at around $2,650 an ounce, but over the past year the gold price is up 30%. That is anything BUT price stability.

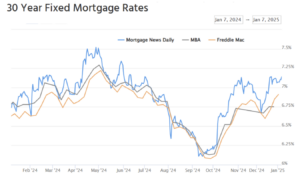

Then there is the 30-year mortgage rate. Did anyone notice the rate rose back above 7%?

On the plus side, the ten-year tips spread – the inflation-protected interest rate – is still at 2.4%. That’s hardly alarming.

The good news is that Trump’s supply side policies – tax cuts, deregulation, and energy production – are just the right antidote to inflation. That can’t come soon enough.