When the pandemic hit last year, left-wing groups like the Center on Budget and Policy Priorities forecast state revenues would fall by 40%.

Those dire predictions inspired Congress to pass a $1.9 trillion blue state bailout. At the time we predicted that states – buoyed by rising real estate and stock markets along with a vaccine-led economic recovery would be fine without Washington’s aid.

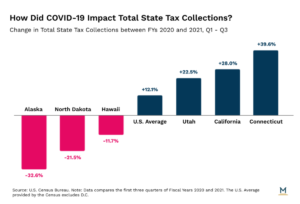

We were right. A Morgan Stanley study reports that “the states collectively are awash in cash.” State tax revenue is up by an average of 12.1 percent.

There are exceptions. Alaska and North Dakota rely heavily on tax revenue from oil production and their revenues have fallen. Hawaii has taken a real hit because of reduced tourism.

But for every state with a revenue loss there are seven or eight with soaring collections. In Massachusetts, revenues are up nearly 9 percent over the projections on which this year’s budget was based.

Commonwealth magazine reports: “The amounts are so big that state officials are having difficulty deciding what to do with it.”

https://commonwealthmagazine.org/state-government/state-tax-revenues-keep-heading-higher/

Well, WE know what they should do with it. CUT TAXES NOW. In response to surpluses, at least five states – Arizona, Arkansas, North Carolina, Utah, and Texas – have cut tax rates this year. Where are the other states?

We can’t help wondering why, with overflowing revenue coffers, do the Democrats in Washington keep sending the states hundreds of billions of dollars they don’t need?