This is a troubling trend: the number of fast-growing, middle-sized companies that are going public is in dramatic decline.

The more than 100 million Americans with 401k plans and other retirement funds need to be able to invest in a wide catalog of companies beyond Amazon, Apple, Boeing, Google, Walmart, and the like if they are to be fully diversified.

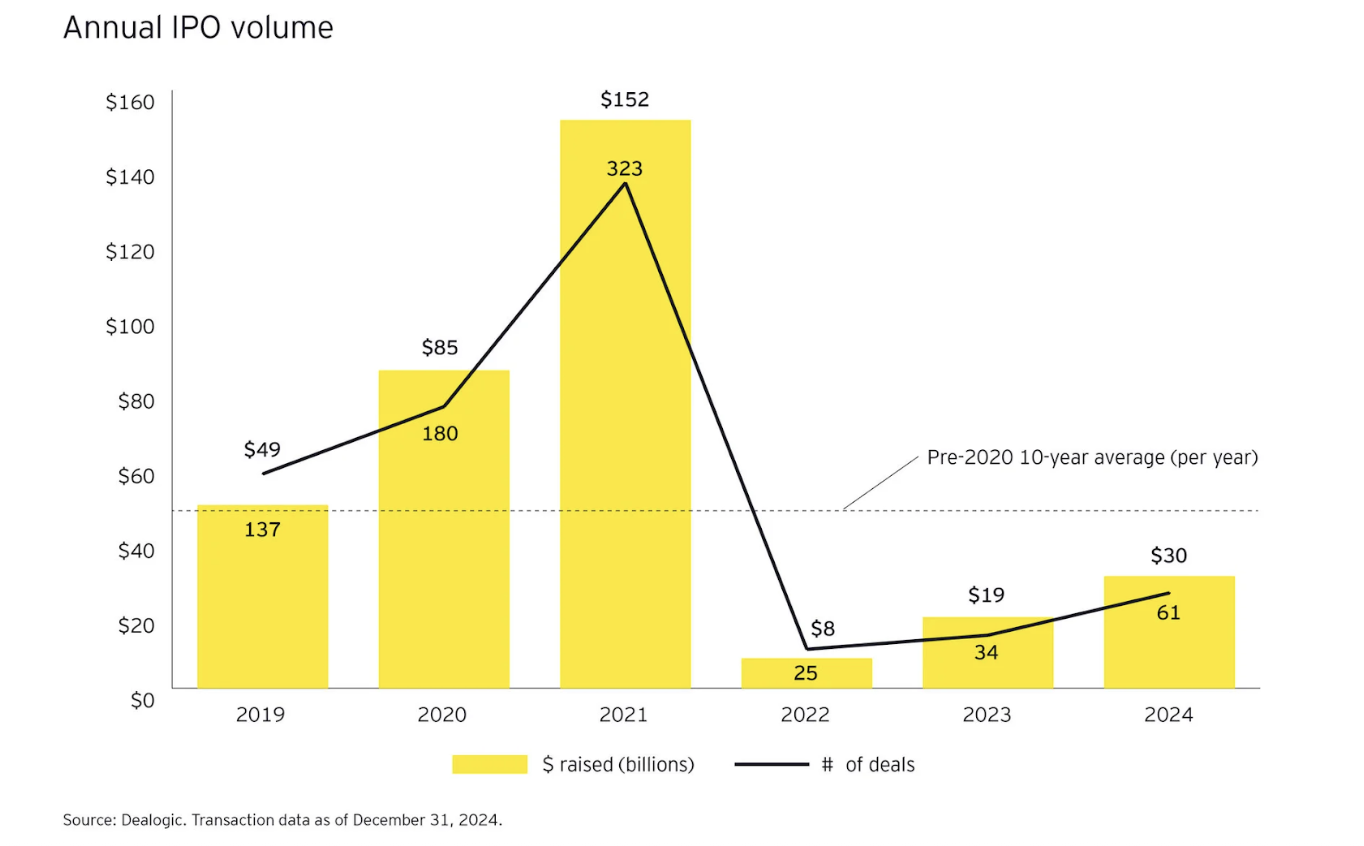

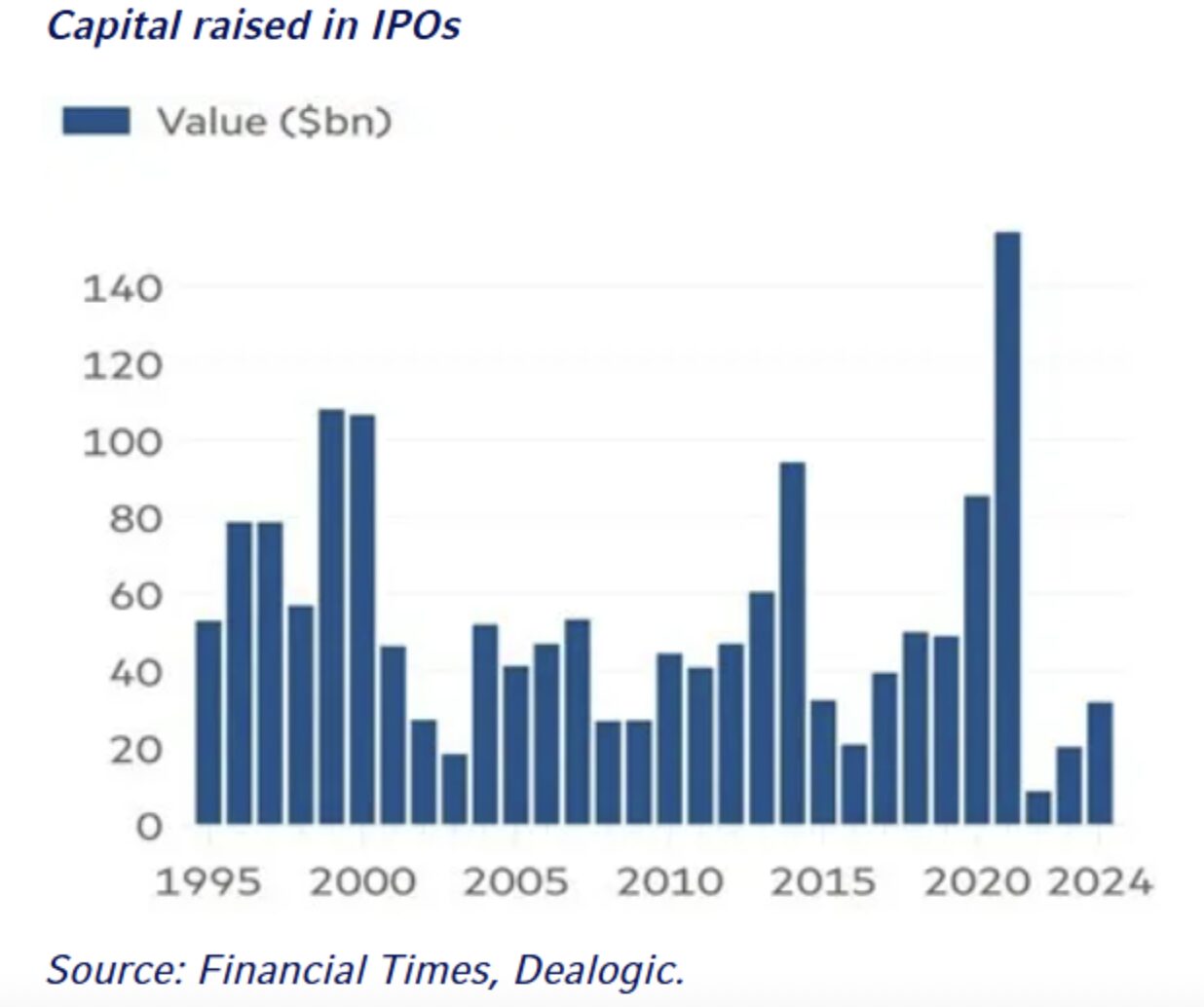

The charts below show the decline in the number of IPOs and the amount of money raised.

The Ernst & Young report found 2023 and 2024 IPO issuances “remained well below the pre-2020 10-year average of $45 billion per year.”

This year, IPOs have been rare so far as well.

There are many explanations, but we agree with a report by Russell Investments that one reason IPOs are on the decline is “SEC-driven increased regulatory and expense burden for public companies.”

We hope that new SEC chairman Paul Atkins reduces these costs so all Americans can have access to returns of up and coming new American companies.