Our friend and budget expert, Matt Dickerson at EPIC, has published a new paper on who pays taxes in America.

The report includes some simple charts of CBO data exposing the big and oft-repeated LIE that “teachers and firefighters pay a higher share of their income in taxes than millionaires and billionaires.”

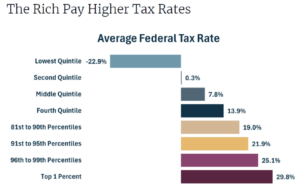

This chart shows the effective tax rate of every income group.

The rich pay about twice as high a tax rate as the middle class.

It is true that some of the very rich in the top 0.1% of income may pay a slightly lower share than those in only the top 1%. These super-rich may pay closer to 20% of their income in taxes, in part, because they have business income that is already taxed and paid at the business level. Somehow, the left forgets to figure in those taxes.

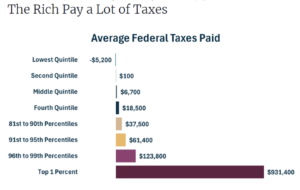

Amazingly, the folks in the top 1% pay an average of nearly $1 million a year in federal taxes, on average. Every year! That’s 20 times what the average family pays.

Almost no country depends on the rich to pay for government more than the USA. The best way to balance the budget is to create more rich people.