We noticed an ad run during the debate opposing the Federal Reserve’s plan to impose even more stringent price controls on the fees banks charge merchants for processing debit card transactions. These price controls were the brainchild of Senator Richard Durbin and were supposed to HELP consumers.

We don’t always agree with the banks, but they have this one right.

As with so many federal regulations, Reg II (pronounced “eye-eye”) didn’t benefit consumers. Instead, it was responsible for millions of Americans losing free checking accounts and debit rewards programs, and as many as a million people going from banked to unbanked. Apparently, Durbin prefers that these lower-income folks go to the local “Checks Cashed” storefront.

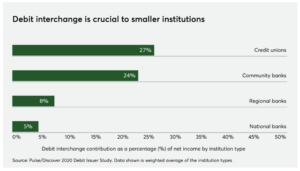

Notably, smaller community banks have been hit the hardest by the existing rule, making it more difficult for them to serve consumers and grow local economies. These institutions and their customers would be hurt the most by the Fed’s plan to tighten debit price controls.

As we noted yesterday, the Fed largely reversed course on capital requirements – they should do the same on debit card price controls. In an ideal world, the next Congress and president would get rid of them altogether.