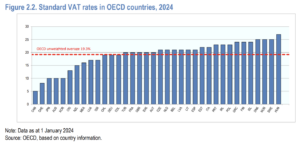

The chart below shows that 175 countries have value-added taxes that are imposed on everything that is imported from the U.S. That includes virtually every nation in the world and literally every OECD member besides the U.S. The VAT is just a sneaky version of a tariff.

This backdoor tariff is on top of their corporate taxes and personal income taxes. The VAT tax is one of the reasons that Europe has flatlined economically for three decades and businesses keep escaping. Their VATs fund their giant welfare states, socialized health care systems, and government spending of 40 to 50% of GDP.

Thank GOD America isn’t burdened with a VAT and thanks to Grover Norquist of ATR for keeping this add-on tax off of these shores.

We raise this point because, although we don’t favor tariffs, the Europeans, Canada, China, and others have a lot of nerve to accuse Trump of starting a trade war with his 10 to 15% tariff talk. Most of our trading partners are at 10 to 20% VATs with tariffs on top of that. So they should just shut up with the self-righteousness.