We’re free traders, but also intrigued by Trump’s concept of taxing the consumption of imports more and taxing things made in places like Michigan, Maine and Maryland less. This would mean a 15% income tax in exchange for, say, a 15% tariff.

UP cofounders Steve Forbes and Stephen Moore argued for a 15% flat tax in the WSJ recently, but maybe the concept could be combined with Trump’s tariff idea. Tax everything at 15% – including wages and salaries, business income, capital gains, inheritances, dividends, and all imports.

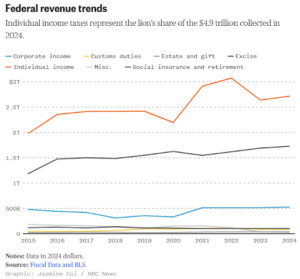

The two charts below show that the American tax system is WAY too dependent on wage and income taxes – which discourage work and investment. Income/payroll taxes account for about 70% of federal revenues while tariffs and duties are closer to 2%. Most other nations gather a much higher share of their revenues via a VAT/tariff on American goods with a rate that can go as high as 20% to 25%.

The 15% tariff, combined with sharply cutting income tax rates to 15% could be pro-growth and achieve Trump’s goal of trade reciprocity.