Wait: wasn’t the Trump Big Beautiful Tax Bill supposed to cause a new rising tide of red ink? In today’s Wall Street Journal, economist Alan Blinder warns of “the fiscal effects” of the Trump tax cut, which he says will make the deficit much worse.

Huh? So far, the opposite has happened.

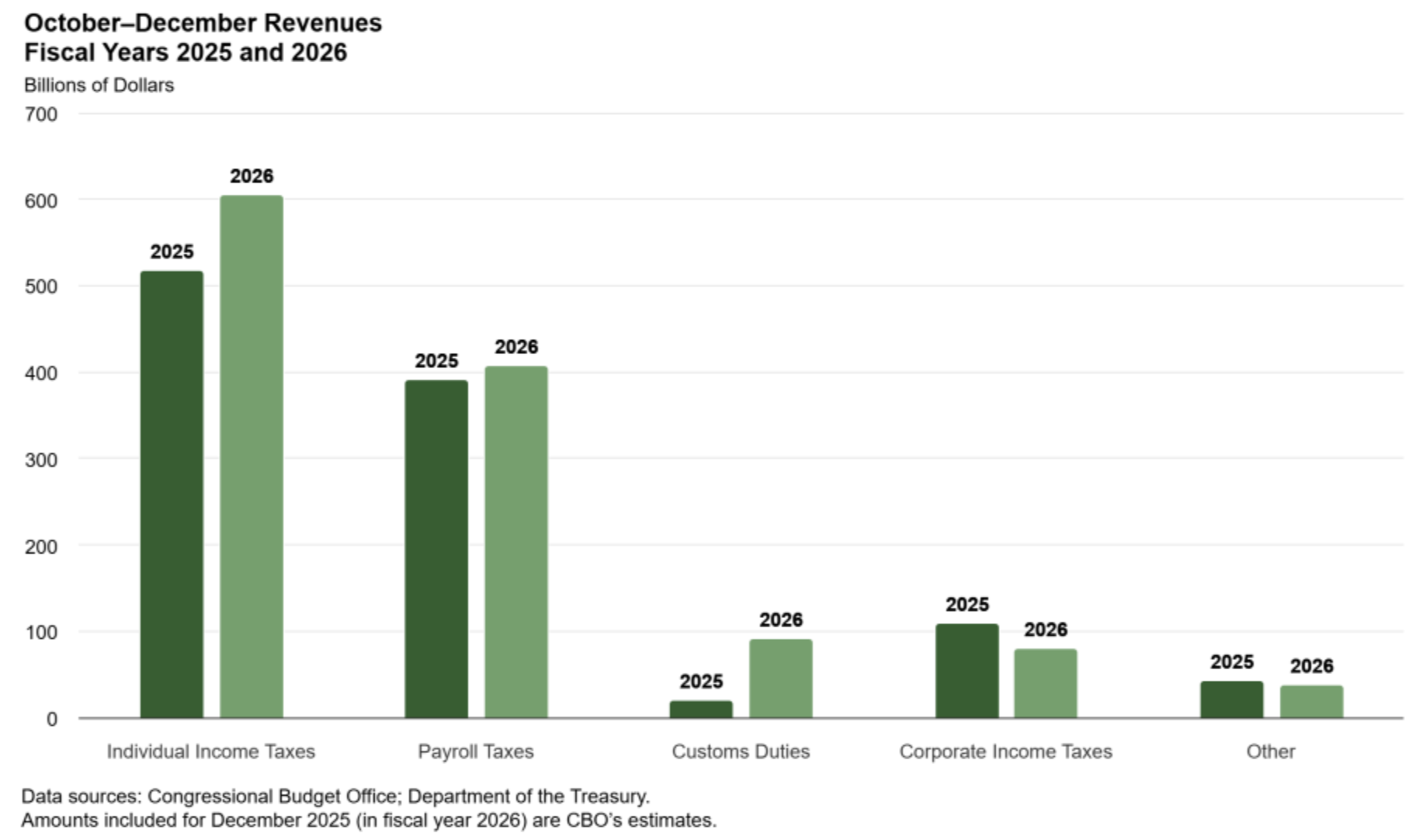

The new federal budget data for the first three months of FY2026 (Oct-Dec 2026) have been released and revenues have leapt $141 billion (13%) higher than at this point last fiscal year.

The biggest increase in revenues came from individual and payroll tax receipts. Here is a quick summary from the Bipartisan Policy Center:

-

-

- $105 billion (12%) increase in individual and payroll tax collections

- $69 billion (322%) increase in customs duties because of increased tariffs in effect for most imported goods

- $28 billion (-26%) decrease in corporate income taxes as H.R. 1 allowed corporations to take larger deductions for certain investments in their 2025 estimated tax filings.

-

The idea behind allowing companies to write off their investment in factories, equipment, machinery, and R&D was to increase business investment due to the lower tax penalty. It’s working. The latest Atlanta Fed Bank report shows investment soaring. This means future tax revenues will be higher than expected.

The bad news is that government spending is continuing to grow like weeds, but the revenues are so high that the deficit is FALLING.