|

Seniors who continue to work and invest, pay the highest tax rates. Those rates can reach above 50% when including the taxation of their Social Security benefits – which were already taxed via the payroll tax on earnings.

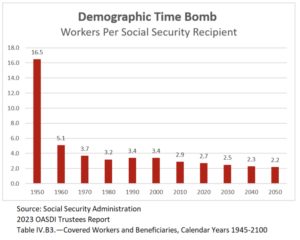

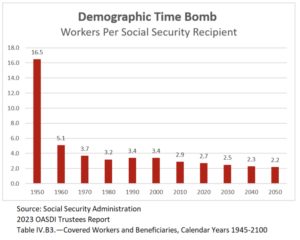

America should be incentivizing – not punishing – seniors for continuing to work past 64. We have many members of Unleash Prosperity who are working in their 80s and 90s. Why should they pay a higher tax rate than everyone else? Demographics make it imperative that we don’t impede seniors from working. Once there were 15 workers for every retiree. Now there are 2.5. And soon, that will be down to just two workers supporting one Social Security recipient.

Also, working longer leads to better health and longer life spans.

Right now, the Social Security Administration estimates that about half of seniors on Social Security pay taxes on their benefits because of other income. That’s millions of seniors ensnared in this anti-work tax.

The average SS benefit is around $2,000 a month – loosely dependent on how much that person paid in and how much they worked.

Who can live on $2,000 a month?

This is why in addition to this new Trump plan, the most critical and urgent reform of Social Security is to immediately allow young workers the option of putting the 12% tax into a 401k plan that earns a rate of return and they own it. Young workers would get three times the benefit they are scheduled to get when they retire. Social Security is the biggest rip-off ever and simply expands a culture of government dependency.

|