President Trump is boasting that as part of his trade deals, the EU and Asian nations have committed to invest hundreds of billions of dollars in the U.S.

Great. More foreign investment on these shores means more jobs and increased valuations of American companies.

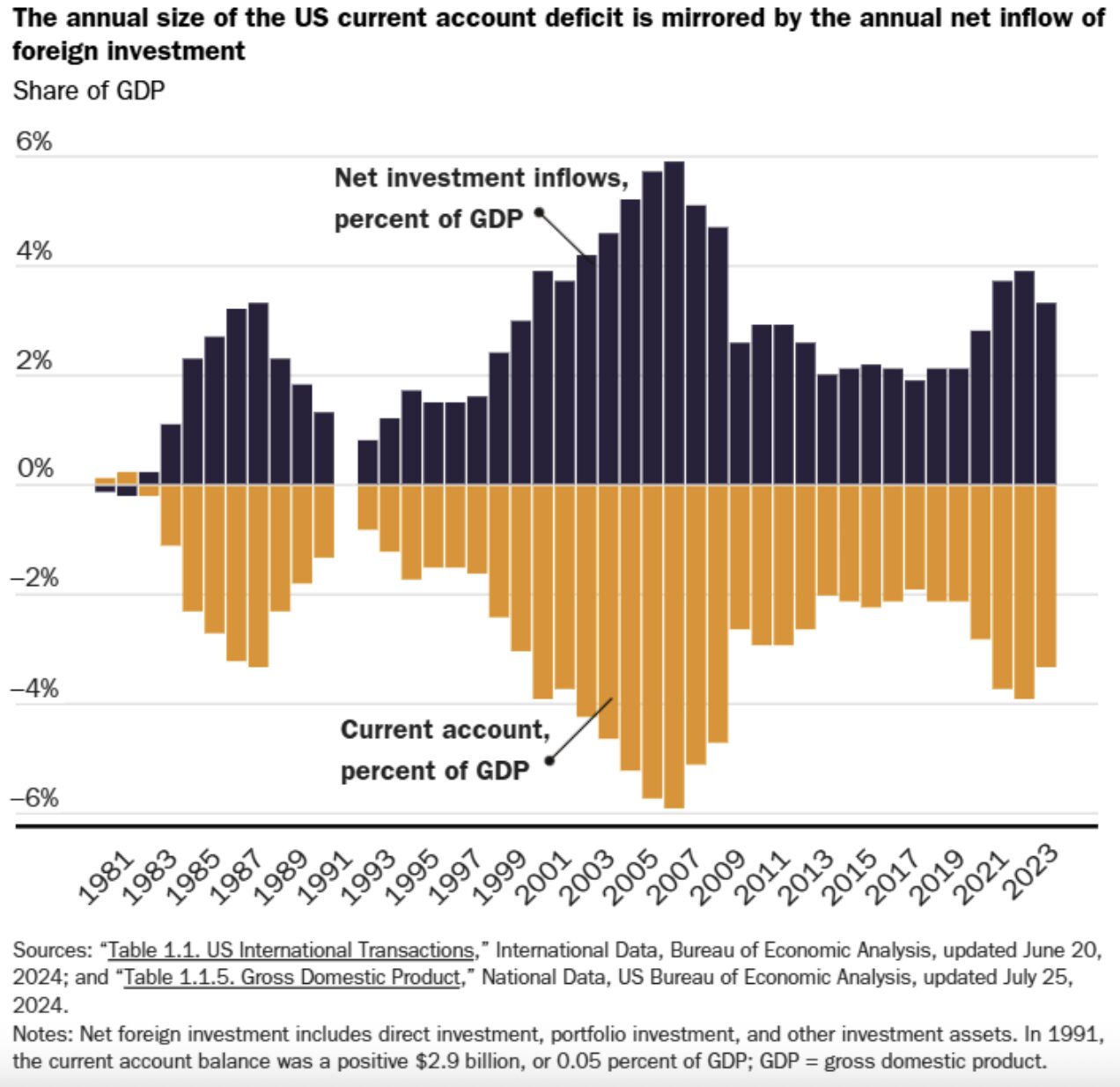

But to obtain the dollars, foreigners need to invest more here; they will have to sell more merchandise to us than they buy from us. Or the dollar will rise in value. Either way, the trade deficit will increase as the foreign investment flows in. The chart below, which we have shown before, is a useful reminder that our trade deficit is the mirror image of our capital import surplus.

On “liberation day” back in April, the White House cited the size of each country’s trade deficit as a highly-suspect measure of whether nations were engaged in unfair trade practices. Tariffs were to be assessed based on those deficits.

We’re all for Trump’s often successful trade deals, forcing nations to reduce their unfair tariffs and non-tariff trade barriers. But the unavoidable dilemma facing the Trump administration is that his policies of attracting capital are likely to make the U.S. trade deficit RISE!

And that will be a valuable lesson in why trade deficits don’t matter.