What‘s the right and fair tax to levy on investments? 10%? 20%? 40%? How about over 100%? Should the government take it all and then some?

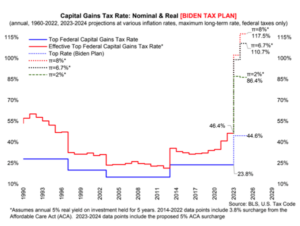

This chart from Laffer Associates shows that Biden’s plan to raise the capital gains tax rate to 44.6% would mean that investors could pay an effective tax rate of 86% on the after-inflation profits from owning an investment – and that’s assuming inflation returns to its 2% Fed target. If the inflation rate stays on its current path of 6.7% the real cap gains tax could reach above 110%.

Our CTUP co-founder Arthur Laffer tells us that because “the nominal rate of return on some investments are below the rate of inflation, the capital gains tax under Biden can reach infinity.”

For example, if you buy a stock for $100 a share and then it rises to $120 per share five years later, but the accumulated inflation rate over that period was, say, 24%, then you lost money owning the stock after adjusting for inflation. But, you would still owe Uncle Sam a 40% tax on the phantom “gain” of $20 per share. This is sheer idiocy.