With wages (5% growth) falling behind consumer price inflation (8% growth), how is it that Americans continue with their spending binge? A big part of the answer, of course, was the massive government spending – which put money in people’s pockets but did so by increasing government debt burdens. This is the essence of Modern Monetary Theory.

The latest Federal Reserve Bank of New York Household Debt and Credit Report indicates it’s not just Uncle Sam that is massively increasing its debt burden.

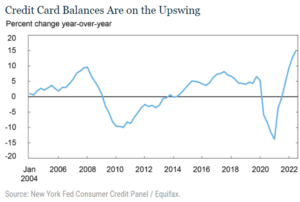

The increase in credit card debt is higher now than at any time in at least 20 years.

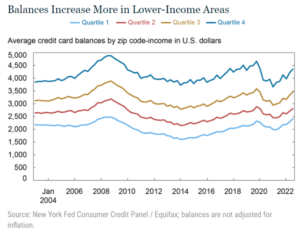

What seems clear to us is that Americans are maintaining their living standards and purchases by plunging further into debt. The lower-income Americans are taking on the most debt:

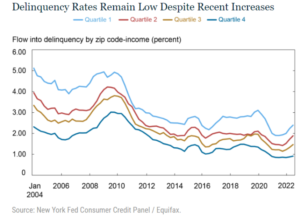

The silver lining is that although defaults and delinquencies are on the rise, consumer delinquency rates are still low historically.

You have to wonder how long that is going to last and whether banks and retail merchants are going to be facing a surge of defaults if the economy slips into recession.