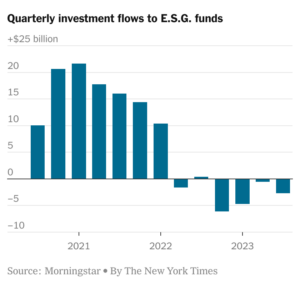

We at CTUP and a handful of other groups have made it a priority to end the scourge of the $1 trillion ESG investing scam – which emphasizes climate change and racial justice over profits and rates of return – and, well, more evidence that we are winning. The downward trend of this fad investing strategy is unmistakable as even the New York Times now acknowledges:

E.S.G. investing is shrinking. Investors pulled $2.7 billion out of E.S.G. funds last quarter, the fourth straight quarter of outflows from such funds, according to data from Morningstar. Most of the withdrawals were from two funds: BlackRock’s iShares ESG Aware MSCI USA ETF, and the Parnassus Core Equity Fund, run by the San Francisco-based Parnassus Investments.

For the first time, U.S. money managers closed more E.S.G. funds than they opened. This may be part of a long overdue shakeout: Following a three-year boom in E.S.G. fund creation, there were 661 in operation at the end of September, up 11 percent since the start of the year.