Fed Chairman Jerome Powell was full of doom and gloom yesterday, forecasting 1.6% growth for this year and closer to 1.5% next year.

Was he talking about Afghanistan or the United States?

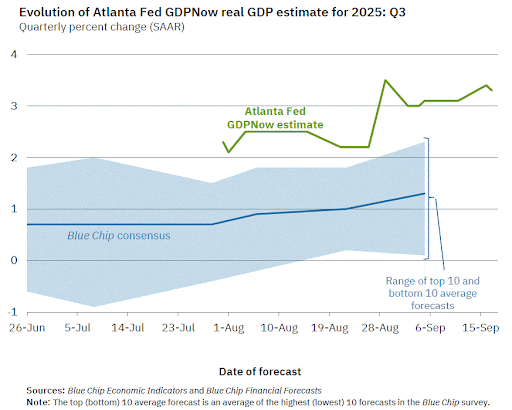

In the second quarter of this year, the U.S. economy grew by 3.3%, and with a few weeks to go in the third quarter, the Federal Reserve Bank of Atlanta is forecasting above 3% growth – twice Powell’s anemic rate.

Powell never mentioned that real household incomes are up $1,100 for the first seven months of 2025.

He attacks Trump’s tariffs and more restrictive immigration policies as restricting growth – and he’s right on that. (See item 2 below.) But he never mentions the Trump tax cut, the immediate expensing for capital purchases (which has spurred an investment boom), the deregulations that could save up to $1 trillion this year, or that Trump’s pro-energy policies have increased U.S. production of oil and gas to record highs, or that the area where job growth is way down is in government employment – which is GOOD for the economy.

There’s also something almost comical of a Fed chair who let inflation soar by 21% and promised it was all “transitory” now terrified of an inflation rate of less than 3% this year.

The Fed should be independent, yes. But it should also be competent and accountable. Under Powell’s reign of error, the central bank has been neither. The end can’t come soon enough.