Jerome Powell hinted at a Fed rate cut on Friday and the stock market indices went on a joy ride.

With a rate cut likely in September, now the issue is: WHICH interest rate should the Fed cut?

Lowering the Federal Funds Rate isn’t going to achieve much, because few banks borrow at that rate today.

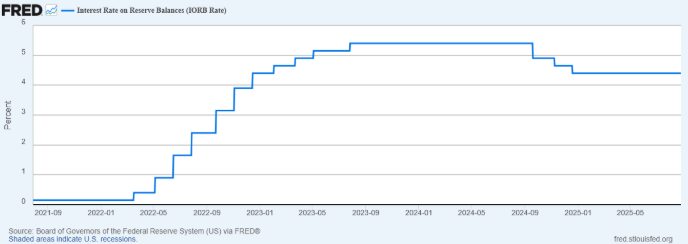

We’re persuaded that Senator Ted Cruz of Texas is right that the Fed should cut the “IOR”, which is the 4.4% interest rate the Fed pays to banks on their reserve balances held at the Fed. The IOR rate has more than doubled from it’s pre-2008 levels.

These are funds that banks do NOT lend out to businesses, consumers, and homebuyers. As monetary expert Judy Shelton has asked: Why bother with private sector borrowers or even investing in traditional Treasury securities that require at least a 10-year commitment, when the returns don’t come close to what the banks are passively getting on overnight cash. Good question!

Today, nearly $3.5 trillion is being stored in reserves at the Fed by banks. High-powered money from bank deposits has become passive money.

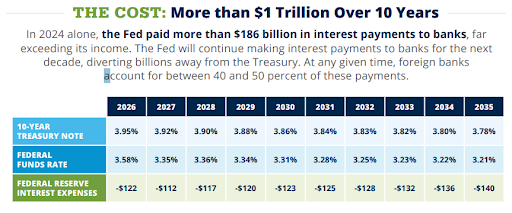

Last year, the Fed paid out $186 billion in IOR to the banks for their not lending. Even foreign banks, which comprise more than one-third of Fed deposits, earn an easy 4.4 percent return.

Gradually lowering the IOR rate would stimulate the economy by incentivizing more bank lending and may save the government money by not paying banks to do nothing.